Bullish View

Buy the GBP/USD and add a take-profit at 1.3750.

Add a stop-loss at 1.3600.

Timeline: 1 day.

Bearish View

Sell the GBP/USD and add a take-profit at 1.3550.

Add a stop-loss at 1.3650.

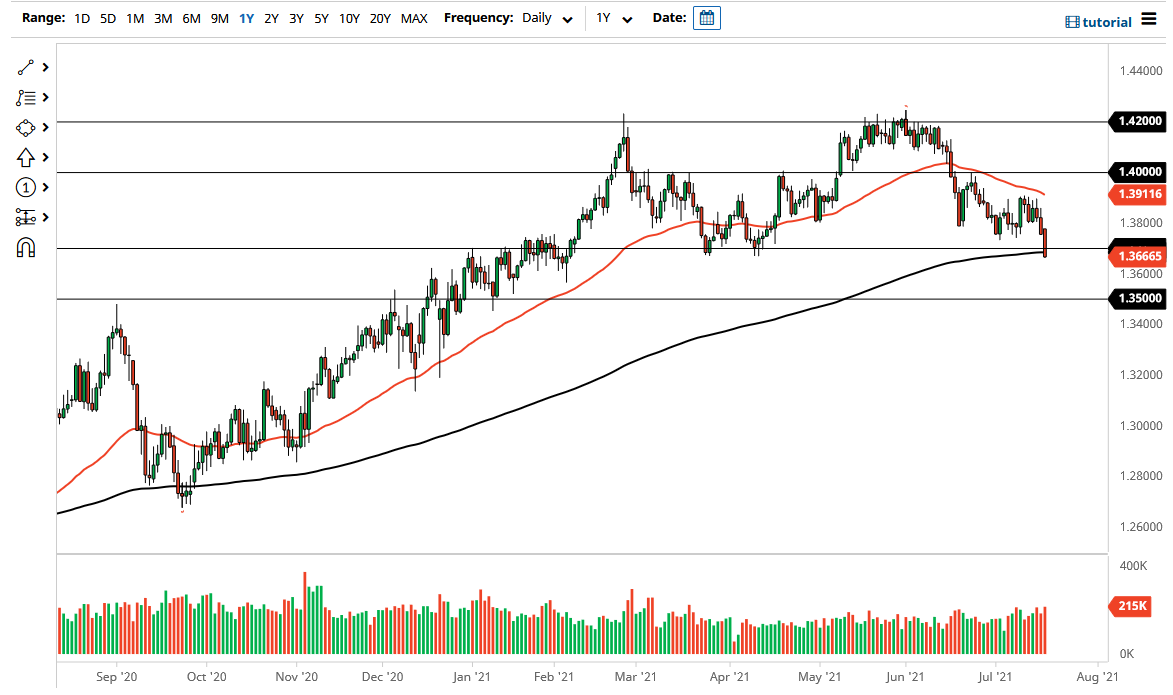

The GBP/USD crashed to the lowest level since April 12 as panicked investors rushed to the safety of the US dollar. The pair dropped to 1.3656, which is about 4% below the highest level since 1.4250.

Sterling Drops on Freedom Day

The GBP/USD declined even as the UK had a troubled Freedom Day. On Monday, the government ended most COVID-related restrictions, even as the number of cases rose and the prime minister quarantined. Still, investors were concerned about this reopening because the country is recording more cases.

Worse, many people who have been admitted in hospitals are those who have received a COVID vaccine. As such, there are concerns that the country will soon go back to lockdown as the disease spreads.

The GBP/USD declined because of the rush to safety as more countries announced rising COVID cases. Thailand, a leading tourism hub reported surging cases. Similarly, in Europe, a French finance minister said that Paris would likely go back to lockdown if cases kept rising.

In Australia, Victoria and New South Wales decided to intensify their restrictions. Therefore, there is a fear that the virus will be around for longer than expected. This, in return, has pushed investors to the US dollar. They even abandoned stocks on Monday as the leading indices crashed by more than 1.50%.

Later today, the pair will likely react mildly to the latest US housing starts and building permits data. Economists expect the number of housing starts rose from 1.572 million in May to 1.59 million in June. They also expect that the number of building permits rose from 1.683 million to 1.7 million as the housing market continued doing well. On Thursday, the pair will react to the latest UK retail sales and ECB decision.

GBP/USD Technical Forecast

The GBP/USD pair declined sharply on Monday. It managed to drop below the important support at 1.3730, which was the lowest level on July 2. It also declined below the 25-day and 50-day moving averages while the MACD also fell to the lowest level since June 22. Therefore, with the pair currently in the oversold level, there is a possibility that it will see a relief bounce as bulls target the resistance at 1.3730. This will likely be part of a break and retest pattern, meaning that the overall trend remains bearish.