Bullish View

- Set a buy-stop at 1.3910 and a take-profit at 1.3960.

- Add a stop-loss at 1.3850.

- Timeline: 1-2 days.

Bearish View

- Set a sell-stop at 1.3870 and a take-profit at 1.3800.

- Add a stop-loss at 1.3950.

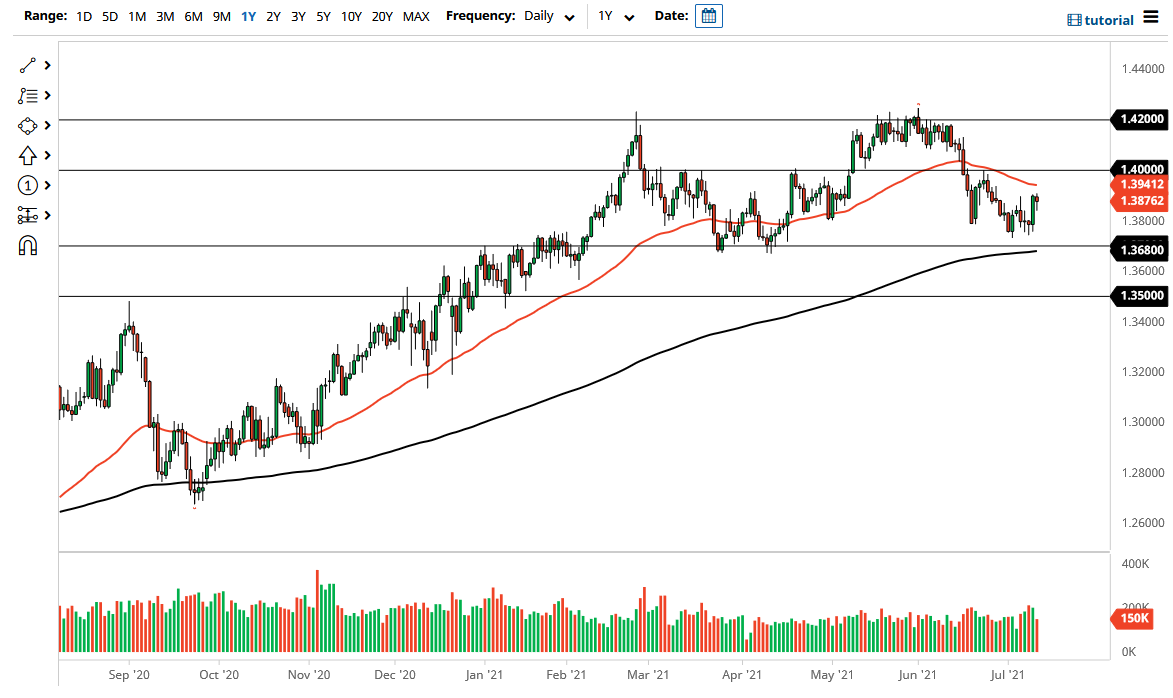

The GBP/USD pair tilted upwards ahead of the latest US inflation data and the upcoming UK reopening. The pair rose to 1.3896, which was about 1.2% above the lowest level last week.

US Inflation and UK Reopening

The key catalyst for the GBP/USD pair will be the latest US inflation data. Economists polled by Reuters expect the data to show that the headline Consumer Price Index (CPI) rose by 0.5% in June after rising by 0.6% in May. The CPI is expected to drop to 4.9% from the previous 5.0% on a year-on-year basis.

Meanwhile, core CPI is expected to rise by 0.4% on an MoM basis and by 4.0% on a YoY basis. The annualized increase will be bigger than the Federal Reserve’s target of 2.0%. It will be the third consecutive month that inflation has been above the 2% target.

If inflation retreats, it will send a signal that the Fed was right that the current situation was temporary. On the other hand, if the inflation beats estimates, it will signify that inflation is here to stay.

The GBP/USD is also rising ahead of the upcoming UK reopening. The government will drop most of the restrictions in the coming week, thanks to its vaccination efforts. At least 80% of the country’s population has received one dose of the vaccine. Still, the biggest concern is that the number of coronavirus cases is rising in the UK. Therefore, a swift reopening may lead to more infections.

The GBP/USD will also react to the start of the US earning season. Companies like PepsiCo, Goldman Sachs and JP Morgan are expected to kickstart the season today. Separately, the Bank of England will publish minutes of its recent meeting and the financial stability report.

GBP/USD Forecast

The hourly chart shows that the GBP/USD has been rising recently. It rose to a high of 1.3896, which is slightly below last week’s high of 1.3910. The pair seems to be forming a double-top pattern whose neckline is at 1.3840. The bullish trend is also being supported by the 25-period and 50-period moving average. The Money Flow Index has moved closer to the overbought level. The pair has also formed a cup and handle pattern, which is usually a sign of continuation. Therefore, the GBP/USD will likely break out higher if bulls can move comfortably above 1.3900.