Bearish View

Sell the GBP/USD set a take-profit at 1.3740.

Add a stop-loss at 1.3900.

Timeline: 1 day.

Bullish View

Set a buy-stop at 1.3850 and a take-profit at 1.3950.

Add a stop-loss at 1.3770.

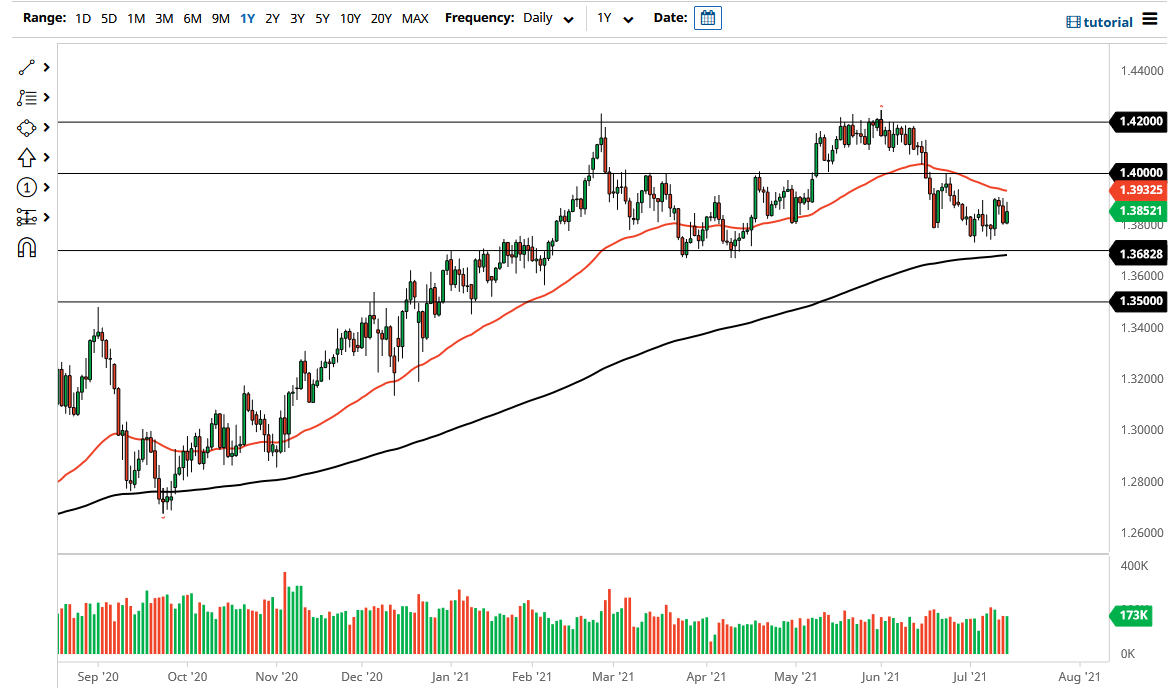

The GBP/USD retreated during the overnight session even after a relatively dovish Jerome Powell testimony. The pair fell from Wednesday’s high of 1.3910 to a low of 1.3825.

UK Employment Numbers Ahead

The GBP/USD pair declined even after the Federal Reserve chair defended the bank’s policies so far. In a statement to Congress, Jerome Powell said that the ongoing inflation was higher and steadier than its estimates. He also repeatedly noted that inflation will soon fall as the economy moves from the transition phase. As a result, he said that the bank will not hesitate to tighten conditions to keep managing prices.

Powell’s statement came a day after the Bureau of Labor Statistics showed that the headline CPI rose by 5.4% in June, the highest level since 2008. Similarly, the core CPI rose by 4.2%, which was the highest level in 30 years.

Elsewhere, in the UK, data published by the Office of National Statistics (ONS) showed that the overall CPI rose to 2.5% in June while core CPI rose to 2.3%. The two numbers were better than the median estimate of 2.2% and 2.0%. Still, this trend is consistent with the Bank of England’s estimate that UK inflation will rise to 3% and then moderate.

The GBP/USD will react to the latest UK employment numbers. The data is expected to show that the unemployment rate dropped from 4.7% in April to 4.5% in May as more businesses continued to reopen. Economists also expect the average earnings with a bonus rose from 5.6% to 7.1% as companies continued o compete for workers. Without bonuses, earnings are expected to rise to 6.6%.

The pair is also in a tight range as investors wait for the upcoming full reopening of the UK economy. While this will likely boost the economy, there are concerns that it will have negative effects as infections rise.

The GBP/USD pair will also react to the latest US initial jobless claims data and the New York and Empire Fed manufacturing numbers.

GBP/USD Analysis

The GBP/USD has been in a tight range in the past few sessions. The pair is trading at 1.3825, which is below this month’s high of 1.3905. On the 2H chart, the pair has moved below the 25-period and 50-period moving average. It is also slightly above the neckline of the double-top pattern. The Relative Strength Index (RSI) has also formed a bearish divergence pattern. Therefore, the pair will likely keep falling, with the next key support being at 1.3750.