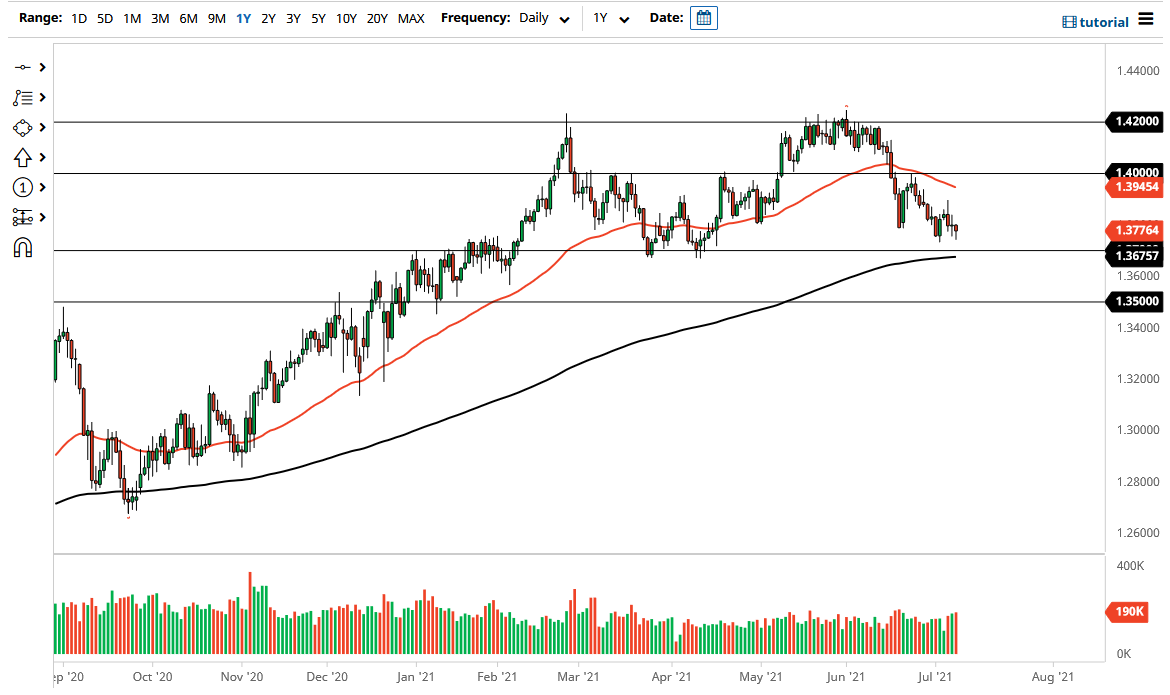

The British pound has fallen a bit during the trading session on Thursday to reach down towards the 1.3750 level only to bounce a bit and form a bit of a hammer. There is a massive amount of support underneath near the 1.37 handle that comes into play, as it has offered support a couple of times in the past. That being said, the 200 day EMA also sits just below there and is flattening out, so I think it is only a matter of time before buyers would come in to try to defend this area.

If we turn around a break down below the 200 day EMA, then it is possible that we could go looking towards 1.35 handle, and then maybe even lower than that. After all, although the 1.35 level is significantly supportive and a large, round, psychologically significant figure, it is worth noting that once we break down below the 1.37 handle we have kicked of a “head and shoulders” pattern, or perhaps even the confirmation of a “double top.” Ultimately, both are very negative and at the end of the day they both measure for a significant move lower.

If we were to break down below the 1.35 level, I suspect that we will probably see this market pick up momentum to the downside, because quite frankly I see a bit of a “air pocket” underneath there. We could see this market looking towards the 1.30 handle, which is a large, round, psychologically significant figure. We do have a lot of noise out there, so it is always possible that perhaps we rally. If we do break above the highs of the trading session on Tuesday, then the market is likely to go looking towards the 50 day EMA. Breaking above there could open up the possibility of a move towards the 1.40 handle. Breaking above there opens up the possibility of the market retesting the 1.42 handle.

I think the one thing we can keep in mind is plenty of volatility, and as a result you probably need to be a bit careful about your position size, because headlines will continue to throw around risk appetite in general, as the US dollar will be picked up if bonds continue to attract as much inflow as they have over the last several weeks.