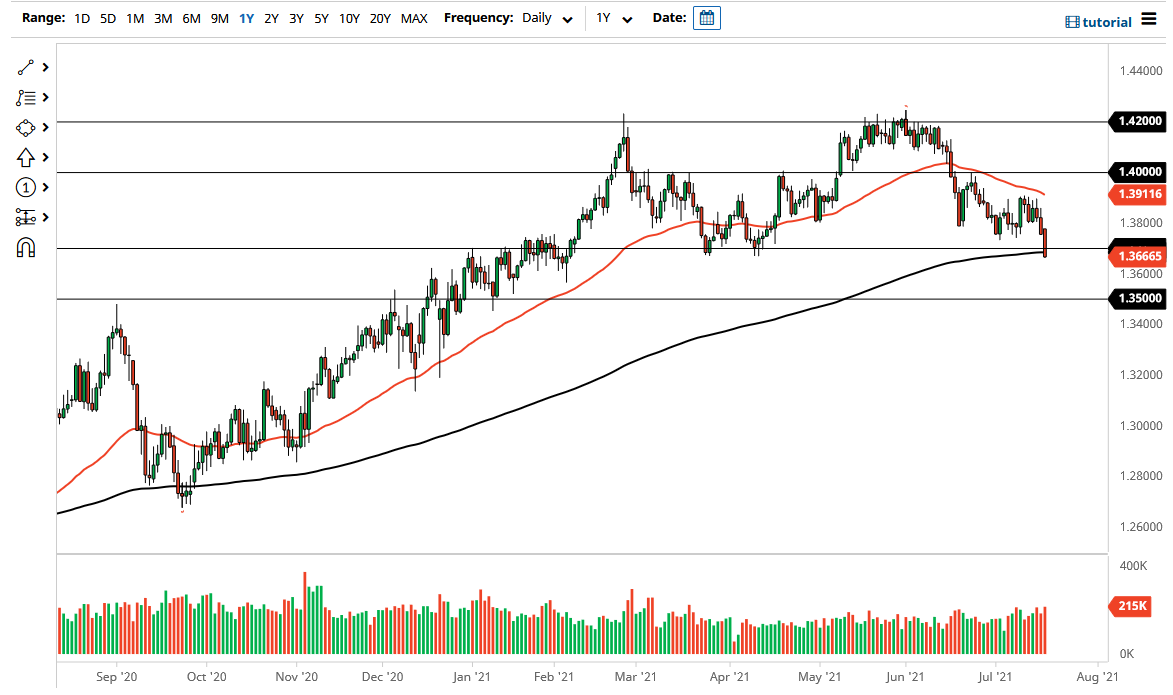

The British pound broke down significantly during the session on Monday as we saw a major breakdown during the trading session. The British pound has seen selling pressure due to the fact that the US dollar itself has been so strong. In fact, I do not even know that this is a move against the British pound so much as it is simply people running towards the greenback.

The 10-year yield has been shrinking lately, and we have broken through some psychological barriers over the last couple of days, driving the value of the greenback higher, which has a bit of a “knock on effect” over here. When you look at this chart, you can see that we have in fact been slumping for a while, but the British pound itself has held up better against the greenback than many of the other major currencies. It is because of this that I still think this market is likely to be negative, but it is also more likely than not to be “less negative” than some other currencies such as the Australian dollar, New Zealand dollar, etc.

If we break down below the lows of the trading session for Monday, I do believe that we will probably go looking towards the 1.35 handle underneath. The 1.35 handle is a large, round, psychologically significant figure, and will attract a certain amount of headline attention. Breaking below that level then breaks the entire trend for me and I believe that the British pound will get absolutely smoked at that point. I am not saying that cannot happen, just that we are quite there yet.

On the flipside, if we take out the losses from the trading session on Monday, the market is very likely to go looking towards the 50-day EMA. The way this market has moved over the last couple of days, though, I am not willing to jump in right away. I think at the very least we need a couple of days’ worth of stability, but I would feel much better if we can break above the 50-day EMA. Right now, the US dollar continues to lead the rest of the Forex world, and as long as that is going to be the case it is very unlikely that this market can rally for a significant move.