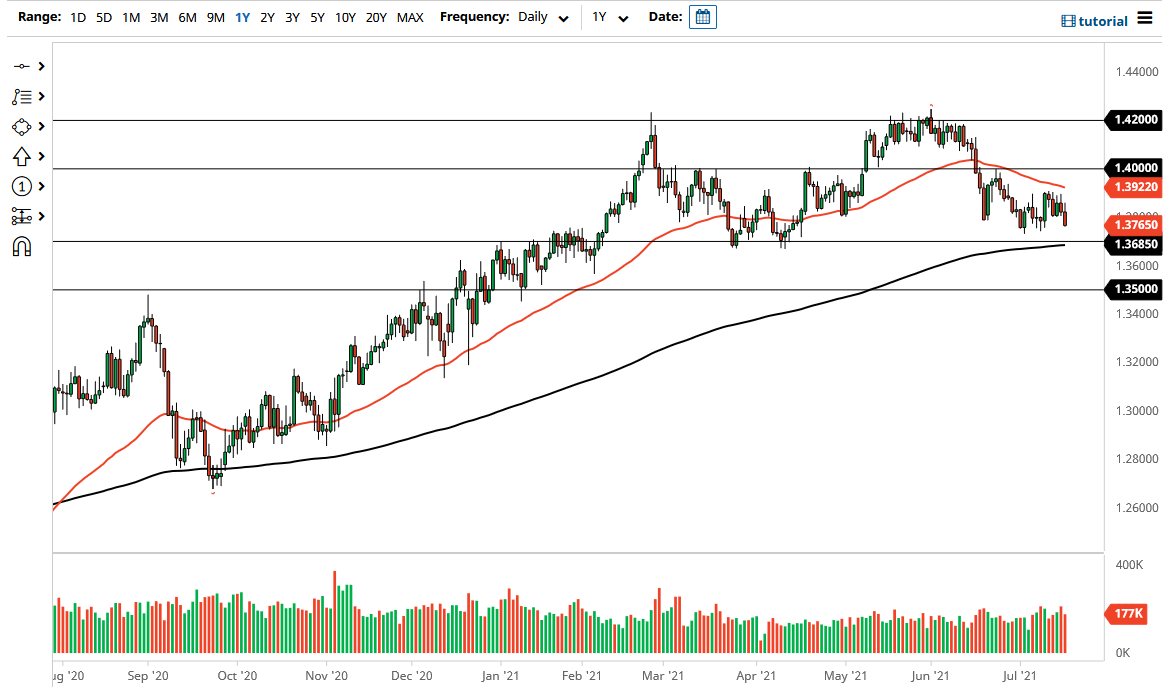

The British pound initially rallied during the trading session on Friday, but then broke down to reach towards the 1.3750 level. Looking at this chart, you can see that the 1.37 level underneath is significant support, as we have tested it multiple times and the 200-day EMA is reaching towards it. If we break down below the 1.37 handle, then it is likely that the market would go looking towards the 1.35 handle. This is probably more about the US dollar than the British pound, due to the fact that the US dollar is gaining against almost everything.

If we were to break down below that level, then it is very likely that we would see a lot of volume coming into the marketplace that will push this market much lower. The 1.35 giving up support would open up a huge move lower, perhaps reaching the market down to the 1.30 handle. Ultimately, this is a market that is going to follow the US Dollar Index and the overall attitude of the greenback in general.

As far as buying this market is concerned, the 50-day EMA has to be broken on a daily close at the very least. At that point, the market is likely to go looking towards 1.40 handle. The 1.40 handle is a large, round, psychologically significant figure, and an area where we have seen action in both directions as of late. Looking at this chart, you can see that we have gradually been “slumping” over the last several weeks, and it certainly looks as if we are going to see more downward pressure. I expect that the US dollar is in the midst of a major turnaround and breakout on the US Dollar Index, and in fact we are closing at the very top of the range for the week. That will translate into this market, so I am looking at this market as one in which I should be a seller of short-term rallies on a breakdown below the 200-day EMA underneath. At this juncture, I have no interest in buying this pair, but if we broke above the 50-day EMA, I would have to reassess what is going on with the US dollar on the whole, not just in this pair.