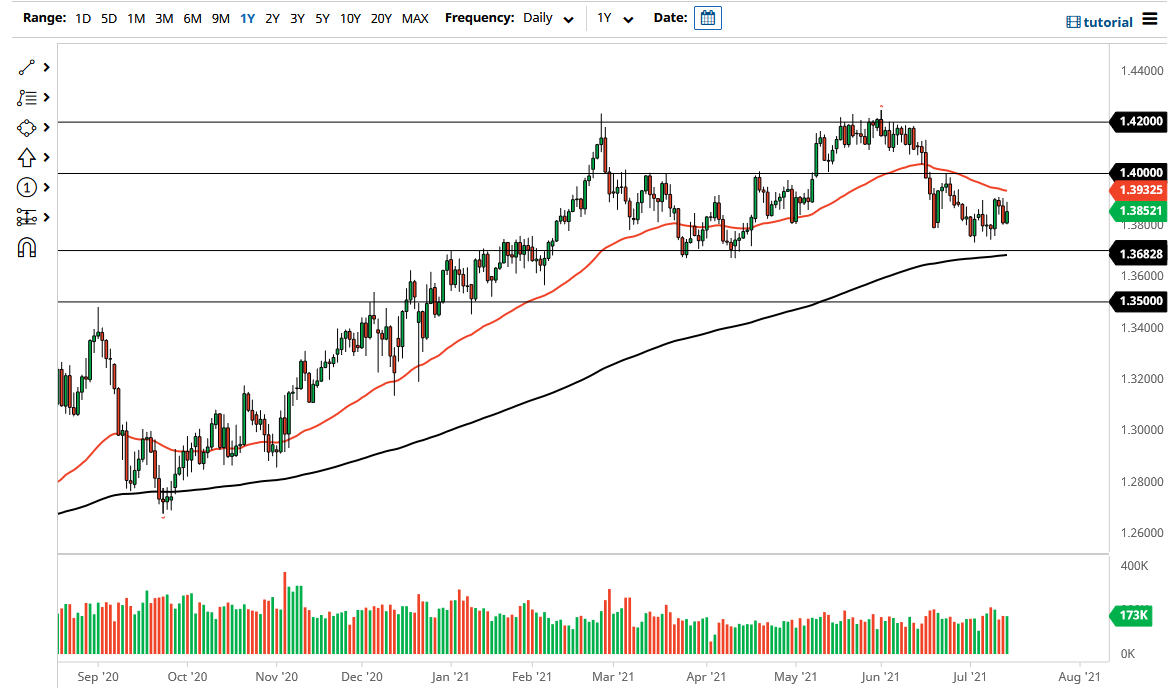

The British pound initially rallied during the trading session on Wednesday but gave back the gains sitting near the 1.39 level. The market then turned around a bit, as we continue to stay in the same general consolidation area. We are looking at a market that is trying to figure out where to go next, as the 50-day EMA above offers resistance, while the 200-day EMA below offers support. The 1.37 level is also massive support based upon recent action, and that sits just above the 200-day EMA.

The market looks as if it is probably going to need to see some type of impulsive candlestick in order to get traders excited, and it is likely that we are simply going to be killing time in a relatively tight range. With that being the case, if you are a short-term trader, that could give you an idea as to how to play this market, because it has been so reliable over the last couple of weeks.

With that being said, the H pattern that had formed previously still is in effect, and we did not make a “higher high” quite yet. However, we need to get below the 200-day EMA to open up the possibility of a move towards the 1.35 handle underneath. The 1.35 handle will offer a lot of psychological importance, and if we were to break down below it, the market would probably start to sell off quite drastically, perhaps reaching down towards the 1.30 handle. On the other hand, if we were to turn around and rally, I would need to see this market break above the 1.39 level on a daily close to even think about going long, and even then, I would have to be worried about the 50-day EMA and the 1.40 handle both offering massive resistance. In other words, I think it would be difficult to get long of this market, but if we did, and the market continued to go higher, then the 1.42 level would be the next significant resistance area. That is an area that has been resistance on longer-term charts, so you should not be surprised at all that it has held so far.