Bank of England member Saunders stated earlier in the session that perhaps the Bank of England would have to raise rates sooner than anticipated, and this has caused a major whipsaw in the British pound against all currencies during the session. In fact, there was one point where the British pound had gained about 60 pips in the course of 15 minutes as he was spouting this off.

However, it seems as if the market faded that rally rather quickly, as the United Kingdom is nowhere near being able to raise interest rates. Furthermore, he was talking about down the road, and is of course only one member of the Monetary Policy Committee. In other words, it is only one piece of the puzzle and simultaneously we continue to see the US dollar strengthen. The main reason for that is that money keeps flowing into the bond markets. That is an interesting conundrum to be in, because the narrative has been inflation for so long this year that one would expect those 10 year note rates to be at 2%. As I write this, they are currently at 1.3% and dropping. In other words, people are throwing money at the US bond market and therefore they will need US dollars. Beyond that, they are also expecting deflation, not inflation. If you ever want to know what is going on, follow with the money goes, not the narrative.

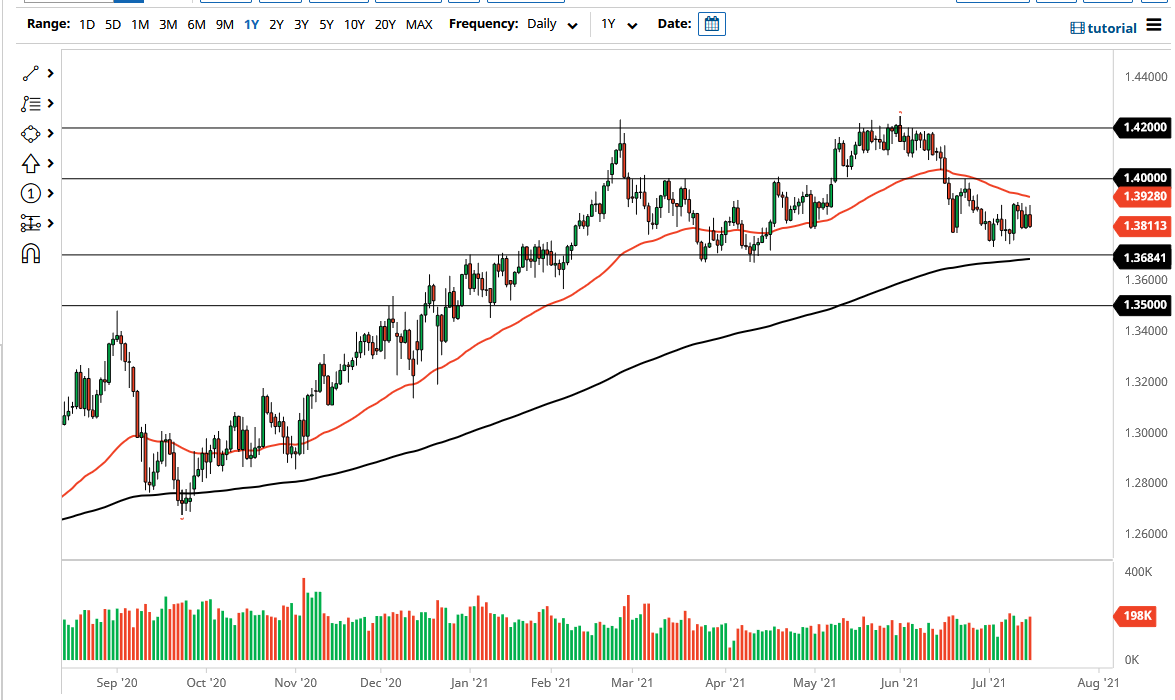

Underneath, the 1.37 level continues offer support, and of course the 200 day EMA sits right there as well. That being said, this is a chart that certainly looks as if we could go to that level rather quickly. If we break down below there, then it opens up the possibility of a move to the 1.35 handle, which then below there we could be talking about a significant longer-term move. The 1.42 level above had been tested multiple times in the past and continues to be a huge “ceiling for the market.” Before we even get there, we have to worry about the 50 day EMA which we have not been able to crack for quite some time. At this point in time, it still looks as if it is a “fade the rallies” type of market in the British pound, or more specifically against the US dollar.