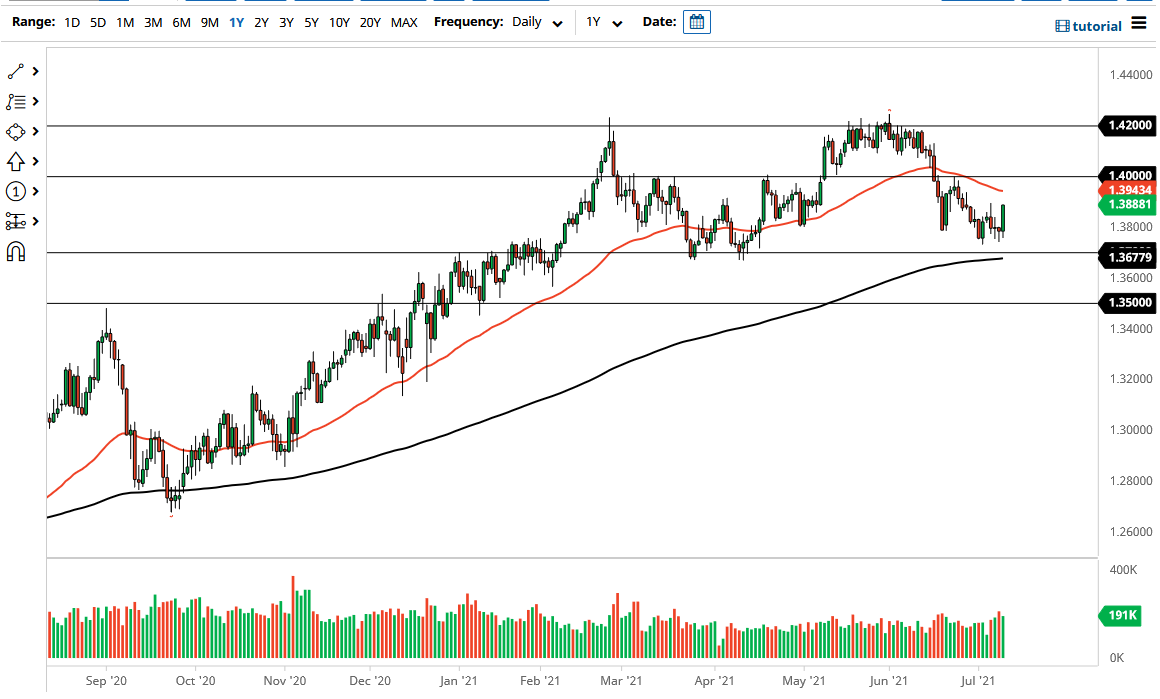

The British pound rallied significantly during the Friday session to reach towards the 1.39 level, in a complete reversal of the massive selling that we had seen recently. The question now is whether or not we can continue to go higher, because we are running into a significant amount of noise just above. The 50-day EMA is starting to come into the picture as it drifts lower, but we also have the 200-day EMA underneath offering significant support. In other words, we are essentially stuck between a couple of major moving averages, as we try to determine whether or not the US dollar can continue to strengthen.

Underneath, we have the 1.37 level offering significant support, and I have to admit that I'm quite impressed by the move and the fact that we are closing at the very top of the range. With this, I do think that we could see the markets continue to go to the upside. I think at this point, the 1.40 level is a major resistance barrier, as it is a large, round, psychologically significant figure, but at the end of the day we are looking at a scenario where the market is trying to recover from the most recent selloff. So, it makes sense that we have seen quite a bit of confusion due to the fact that yields in America have been dropping, meaning that people are throwing money into the bond market.

To the upside, the 1.42 handle has been a major resistance barrier more than once, and when you look at the monthly charts, it most certainly has been very important. The 1.42 level continues to see a lot of interest every time we get there, so it will be interesting to see if we can make that attempt again. There are lot of questions now as to where we are going longer term, but if we do get above there, the market could take off to the upside. On the other hand, if we were to turn around and break down below the 200-day EMA, the market would likely go looking towards the 1.35 handle, which is the gateway to much lower prices, perhaps the 1.30 handle after that.