This is the lowest in more than three months and was stable around it at the time of writing the analysis. As I mentioned at the beginning of this week's trading, it will remain under pressure until the European Central Bank, led by Lagarde, announces an update of its monetary policies tomorrow, Thursday. The increase in injuries and global fears of the outbreak of the Corona Delta variable negatively affects the morale of investors to take on risk.

In light of the preparations of the markets and forex investors for the announcement of the European Central Bank, it must be noted that, in an ever-evolving economic environment, the major global central banks have the strict task of reviewing their strategy and adjusting the policy framework periodically. For the Federal Reserve and the Bank of Canada (BoC), for example, this review is usually done every 5 years.

The European Central Bank, for its part, completed its last review in 2003 and, after nearly two decades, recently released the results of its 18-month monetary policy strategy review. In an effort to provide more clarity, the European Central Bank has adjusted its inflation target to be more in line with the global benchmark at a flat 2% level.

Contrary to the Fed's average target of 2%, which allows inflation overruns, the ECB does not appear to be accommodating deviations outside its target, at least not in the long run. With the strategy review now complete and a new inflation target set, it will be interesting to see how the ECB adjusts its forward guidance at the upcoming policy meeting.

After a shift in rhetoric from the Federal Reserve last month, central banks around the world have been active in discussions or working on gradual strategies as seen by the Bank of Canada, the Reserve Bank of New Zealand, the Reserve Bank of Australia and the Bank of Norway. The European Central Bank was quick to reject any consensus on this path and went to great lengths to highlight the differences between regions. However, with the ECB now revising its inflation target, there is more room for the central bank to ramp up its purchases of pandemic-related assets to stimulate activity in a region that has suffered from low inflation levels over the years.

This could result in the continuation of accommodative policy measures beyond the specified expiration of the Pandemic Emergency Purchase Program (PEPP) in the spring of 2022. In this case, the policy divergence with other central banks will continue to drift and lead to a further decline in the Euro. There has been a good sell-off in the EUR in recent weeks, and we have seen a drop in net longs. The market is looking forward to the next ECB meeting tomorrow 22nd July and will assess the impact of its new policy strategy and how it affects future guidance.

In order to support the new inflation mandate, I would expect a dovish tone from the ECB along with a commitment to hold/extend its policy. It is fair to say that more monetary stimulus may also be required to support the higher inflation target, and the market will be looking for a signal from the European Central Bank on the scale of its asset purchases going forward.

Despite the latest Eurozone inflation data hovering just a mark below 2%, policy makers ignore price hikes as temporary and continue to focus on high unemployment levels, indicating a somewhat weak medium-term outlook.

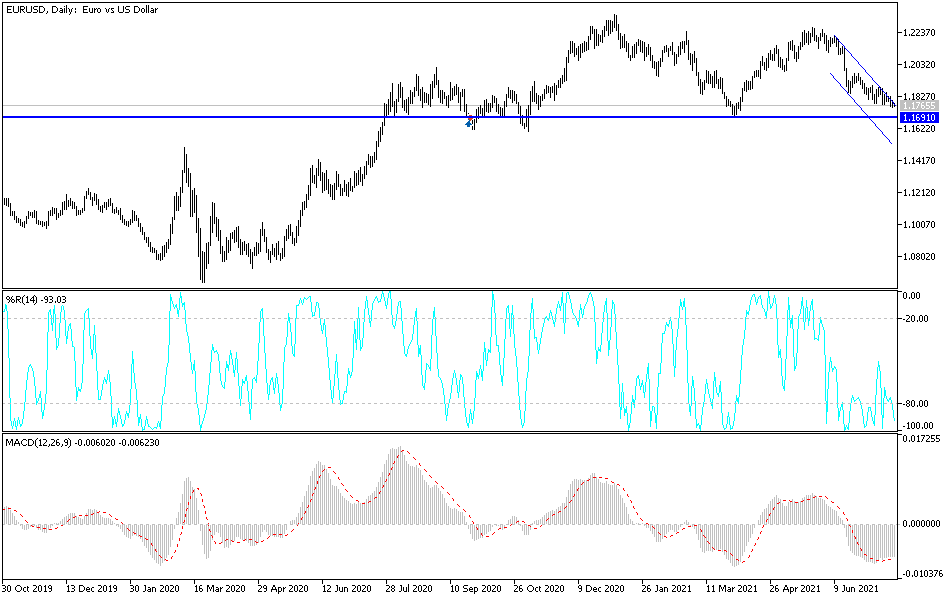

According to the technical analysis of the pair: On the daily chart, the price of the EUR/USD currency pair is still moving within its bearish channel that was formed recently, with the confirmation that moving towards the support levels 1.1710 and 1.1645 will push the technical indicators over the same time period to strong following levels by selling. But the persistence of stress factors does not prevent this from happening and more. On the upside, I still see that the psychological resistance 1.2000 is the most important for the bulls' return to dominate performance again. Otherwise, the general trend for the EUR/USD will remain bearish.

Today's economic calendar is devoid of any important and influential economic releases from the Eurozone or the United States of America.