After completing the testimony of the US Federal Reserve Governor Jerome Powell, the dollar was negatively affected, which allowed the currency pair to settle around the resistance level 1.1840. Despite the rebound, the euro is still facing renewed investor fears of the rapid spread of the Corona virus, coinciding with plans for economic openness. This may increase the suffering of the euro bloc in the recovery from the effects of the pandemic.

Some regions in Spain are aiming to put restrictions back in place due to the sharp rise in coronavirus cases. Northeastern Catalonia, home to Barcelona and northern Cantabria, has issued orders for a nighttime curfew that must be approved. Both areas want people off the streets after 1 a.m. A court in the Canary Islands rejected a request by the regional authorities in the archipelago to implement a similar curfew.

Spain has been seeing an increase in infections in recent days as the delta variant sweeps across smaller segments of the population, which have a lower vaccination rate. Catalonia is one of the hardest-hit regions in Europe, with more than 1,000 cases per 100,000 inhabitants over a 14-day period. The average is 3,300 cases for those aged 20-29.

The delta variant is causing an increase in the number of cases worldwide, including Italy. There were 2,153 confirmed cases in the past 24 hours, according to Italian Health Ministry figures yesterday. That is more than double the number of confirmed infections of 1,010 a week ago. Health experts say the sudden rise in the number of cases has not led to sharp increases in ICU admissions or deaths. This is partly due to vaccinations and the average age of newly infected people is 31 to 35, much younger than it was early in the pandemic.

The Ministry of Foreign Affairs advises travelers who are required to undergo swab tests for the Corona virus who enter or return to Italy to consider the result positive. This could mean that travelers, as well as those in close contact, may face quarantine. Meanwhile, Malta watered down a new rule requiring proof of coronavirus vaccination to enter the country after the European Commission raised concerns it could impede the right to freedom of movement within the 27-nation bloc.

In the USA, with one of the highest vaccination rates in the world, newly confirmed infections have doubled daily over the past two weeks to an average of about 24,000. Deaths are still on a downward trajectory at about 260 deaths a day. On another influential note, Federal Reserve Chairman Jerome Powell said that inflation, which has been rising with the strength of the recovery, is “likely to remain elevated in the coming months” before the “moderation.” Meanwhile, in testimony before the House Financial Services Committee, Powell indicated that no change was imminent in the Fed's ultra-low interest rate policies.

The Fed chair reiterated his long-held view that high inflation readings over the past several months were largely driven by transitory factors, notably supply shortages and increased consumer demand as business restrictions linked to the pandemic are lifted.

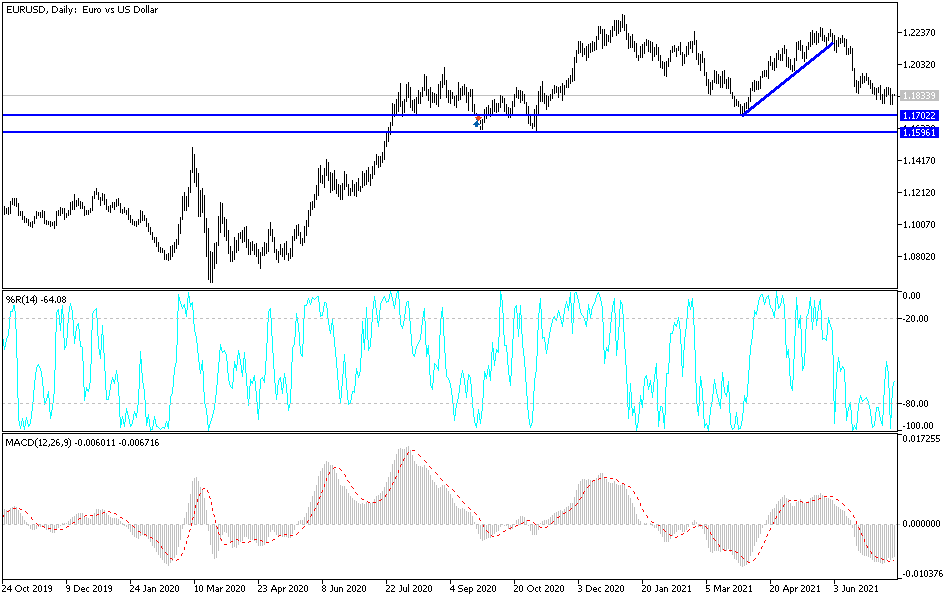

EUR/USD Technical Analysis: On the daily chart, the bears' dominance over the stronger EUR/USD performance and attempts to rebound higher still lack sufficient momentum to turn the trend. As with the recent performance, the EUR/USD's decline below the 1.1770 support level will push the technical indicators to oversold levels. I prefer to consider buying from the support levels 1.1735, 1.1685 and 1.1600, respectively. On the upside, the bulls will not control the performance again without penetrating the psychological resistance 1.2000 as a first stage. For the time being, the euro's gains will continue to face the threat of increasing European casualties and diverging economic performance and monetary policy between the eurozone and the United States.

As for the data of the economic agenda today: devoid of European economic data and all the focus on US data, jobless claims, reading the Philadelphia Industrial Index, the US industrial production rate, and the second testimony of Federal Reserve Governor Jerome Powell.