The euro-dollar currency pair is affected by the future of Corona’s deregulation or its return, especially with the rapid spread of the delta virus variable that terrified the world, as its origin in India caused disasters there. The return of restrictions will lead to a faltering path of economic recovery. This is in addition to the future of monetary policy. The contrast is very clear between the Federal Reserve and the European Central Bank.

With COVID-19 cases on the rise again, German officials said authorities needed a "broader focus" beyond the country's infection rate to gauge the impact of the pandemic on the health system and what kind of measures should be taken. For most of the past year, the infection rate - the number of confirmed COVID-19 cases per 100,000 people each week - has been key to government decisions about which restrictive measures to impose. The significance of this number is increasingly called into question by those who argue that the sharp rise in new cases - which has already been observed in other European countries such as Britain and the Netherlands - does not necessarily mean more seriously ill patients.

German Health Minister Jens Spahn said on Twitter: "Given the vaccination of high-risk groups, a high infection rate does not automatically mean a large burden on intensive care beds." "The injury is increasingly losing its relevance, we now need more detailed information about the situation in clinics."

His department said that from Tuesday, hospitals will need to send in more data about COVID-19 patients, including names, type of treatment and vaccination status. The German government says 58.5% of the population has received at least one dose of the vaccine, and 42.6% have received a full vaccination. The number of daily injections has decreased slightly in recent days, raising concerns that "vaccine inactivity" or even outright refusal to vaccinate may hinder efforts to achieve so-called "herd immunity".

Germany's disease control agency said last week that the country should aim to vaccinate 85% of people aged 12-59 and 90% of people over 60 to prevent the delta variant that is causing a resurgence of coronavirus cases. In the fall and winter. On Monday, the Robert Koch Institute reported 324 new cases of coronavirus and two deaths in the past day, bringing the death toll since the start of the pandemic to 91,233.

Government spokesman Stephen Seibert said tracking case numbers was still important and that Germany was closely monitoring the situation in countries such as Britain, Spain and the Netherlands, which eased restrictions only to raise the number of infections.

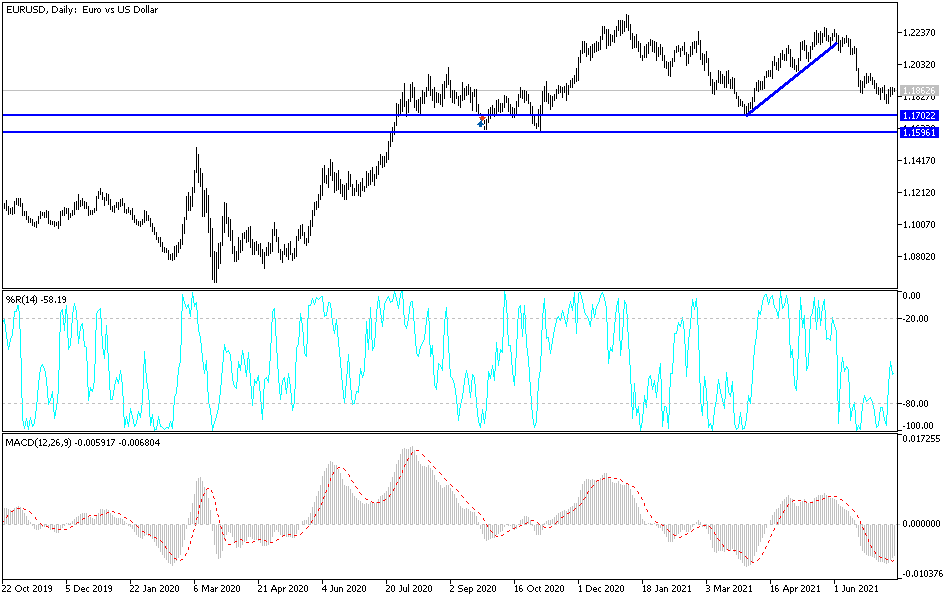

According to the technical analysis of the pair: On the daily time frame, the price of the EUR/USD currency pair is still moving within a descending channel range, and the upward correction attempts will not succeed without breaching the psychological resistance 1.2000. as a first stage. The pair is in a relatively neutral position with a more bearish bias so far. The closest targets for the bears at the moment are 1.1790, 1.1700 and 1.1655. Bearing in mind that the second and third levels will push the technical indicators to strong oversold levels. So far I still prefer buying the pair from every bearish level.

The Euro will be affected today by the announcement of German inflation figures. The US dollar will be affected by the announcement of US inflation figures, by reading the consumer price index.