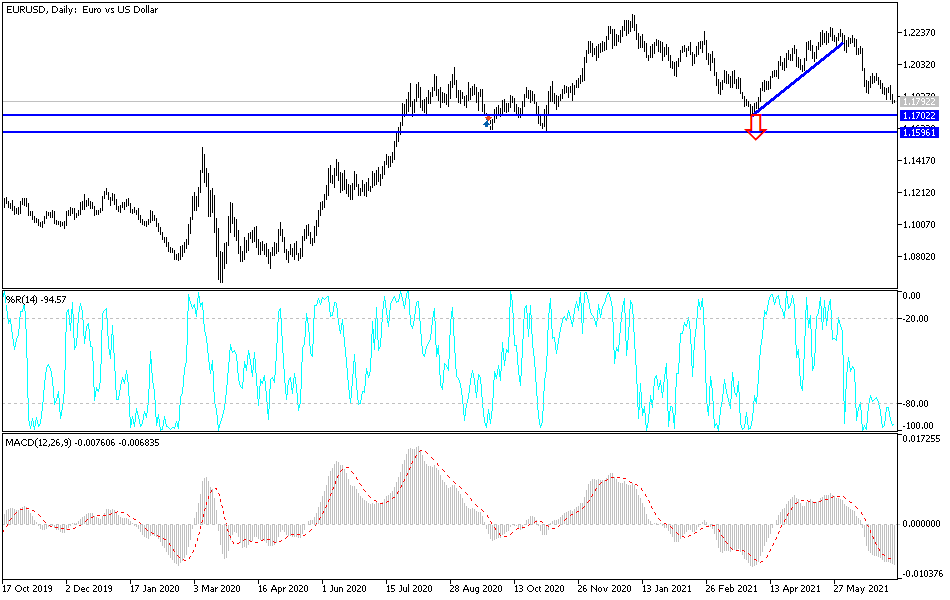

The Fed’s confidence in the US economic recovery and policy tightening is imminent. These factors contributed to new selling operations for the EUR/USD currency pair in the recent trading sessions. Accordingly, the pair fell to the 1.1782 support level, its lowest in three months, before settling around the 1.1797 level at the time of writing the analysis, waiting for any new developments.

Yesterday the European Commission raised its growth forecast for the Eurozone and warned that inflation could be higher than expected if supply constraints persist. The European Union's executive arm said in its latest summer forecast that the eurozone is expected to grow by 4.8 percent this year. This is stronger than the spring forecast of 4.3 percent. Forecasts for next year rose to 4.5 percent from 4.3 percent.

The EU's growth forecast for this year was boosted to 4.8 percent from 4.2 percent. The forecast for next year was raised to 4.5 percent from 4.4 percent. The report stated that "the uncertainty and risks surrounding the growth outlook are high, but they remain generally balanced." The committee highlighted the need for another rapid increase in full vaccination against the Corona virus, citing the threat posed by the spread and emergence of aggressive variants.

The EU also said that the way households and businesses respond to changes in restrictions and the impact of withdrawing emergency policy support will determine economic risks. The committee expects growth to return to its pre-crisis level in late 2019 in the last quarter of this year, one quarter earlier than projected in the spring forecast for the eurozone.

The report added that economic activity in the fourth quarter of 2022 will remain about 1 percent shy of the level projected before the pandemic. The pace of recovery is expected to vary widely across member states, with some expected to see a return to pre-pandemic levels as early as the third quarter of this year, while others will likely take longer.

Growth forecasts for Germany for this year and next have been raised. France's forecast for this year was raised, while forecasts for next year were left unchanged. Growth forecasts for Spain and Italy have been raised for this year, while forecasts for next year have been lowered.

The committee also raised inflation expectations for the eurozone for this year and next.

"Inflation may turn higher than expected if supply constraints persist and price pressures are transferred to consumer prices more aggressively," the report added. Average inflation expectations in the euro area rose to 1.9 percent from the 1.7 percent forecast earlier. Forecasts for next year rose to 1.4 percent from 1.3 percent.

EU price growth is expected to average 2.2% this year versus 1.9% previously expected. Next year's forecast was raised to 1.6 percent from 1.5 percent. The upward pressure on inflation is expected to come from higher energy and commodity prices, production bottlenecks due to shortages of some input components and raw materials and capacity constraints against rising demand at home and abroad.

Pressures are expected to gradually ease as supply constraints are resolved, backlogs cleared, and demand growth moderates.

According to the technical analysis of the pair: Loss continues for the EUR/USD currency, and the breach of the 1.1800 support reinforces the bears’ control over the pair, thus preparing for stronger support levels, the closest to them currently are 1.1765, 1.1680 and 1.1600, respectively. As mentioned before, there will be no chance to exit the current descending channel without breaching the psychological resistance 1.2000. The current performance may enhance the bearish closing of the currency pair for this week's trading.

Economic calendar data today: The German trade balance and a report from the European Central Bank will be announced as well as the announcement of the number of US jobless claims.