The continued flight of investors from risk amid fears of the rapid spread of the Corona Delta variable, which threatens the global openness, contributed to a continuous downward pressure for the EUR/USD currency pair. Its losses last week affected the 1.1753 support level, its lowest in three months, and followed the announcement of the monetary policy of the European Central Bank on Thursday. The continued flexibility of the euro-dollar exchange rate has divided opinion among analysts as market attention turns toward the July policy decision from the US Federal Reserve (Fed), the next test of whether the single European currency can continue to challenge the dollar's allure.

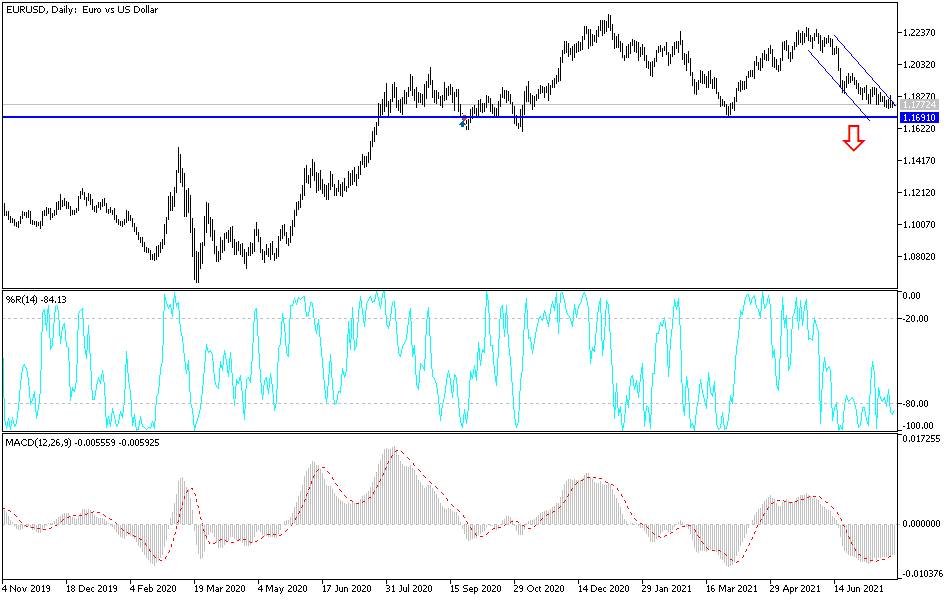

The EUR/USD rate has been steadily declining since early New Year 2021, although it has missed out on plenty of opportunities to recoup larger losses including fundamental and technical catalysts and has stayed comfortably above its 2021 lows to date. This downward drift has left the bullish trend appearing on the charts and by those who argue that the Euro is only in the midst of a temporary correction, rather than seeing the strength of its rally over the course of the year. However, others cite the repeated failure to sustain moves above the $1.18 high as confirmation of the pending change in the overall direction of the EUR/USD. Credit Suisse's technical analysis team cites 1.1825 and around 1.1880 in EUR/USD as major technical resistances that must be overcome in order to neutralize their bearish view.

On the economic side, the EUR/USD currency pair is trading amid interaction with the announcement that the preliminary EU Markit PMI for July exceeded expectations at 60 with a reading of 60.6. The manufacturing PMI beat expectations by 62.5 with a reading of 65.6. On the other hand, the Services PMI beat expectations with a reading of 59.5 with a reading of 60.4. The PMIs for the manufacturing and services sectors in Germany also beat expectations. Earlier last week, the European Central Bank kept the key rate unchanged at 0.0% while the key deposit rate remained unchanged at -0.5%.

From the United States of America, the preliminary Markit manufacturing PMI for July beat expectations by 62 with a reading of 63.1, while the services PMI lost expectations of a reading of 64.8 with a reading of 59.8. Earlier last week, the number of US weekly jobless claims was announced, which rose to 419,000, higher than expectations that had indicated a reading of 350 thousand claims. While continuing claims also came in higher than expected. US Building Permits for the month of June missed the expected number of 1.7 million at 1.598 million while housing starts exceeded expectations by 1.59 million at 1.643 million.

According to the technical analysis of the EUR/USD: In the near term and according to the performance on the hourly chart, it appears that the EUR/USD is trading within the formation of a descending channel. This indicates a significant bearish momentum in the market sentiment. Accordingly, the bulls will target potential retracements around 1.1781 or higher at 1.1800. On the other hand, the bears will look to extend the decline towards the 1.1752 support or lower to the 1.1734 support.

In the long term and according to the performance on the daily time frame, it appears that the EUR/USD is about to complete the formation of a double top reversal pattern XABCD. This indicates that the bears are trying to gain long-term control of the currency pair. Accordingly, the bears will target long-term profits around 1.1707 or lower at 1.1646. On the other hand, the bulls will look to pounce on potential retracements around the 1.1821 resistance or above at the 1.1879 resistance.

As for today's economic calendar data: The German Ifo business climate will be announced, followed by the number of US new home sales.