Despite attempts to stop losses for the EUR/USD price at the end of last week's trading, the pair rebounded to the 1.1874 level before settling around the 1.1865 level at the beginning of this week's trading. EUR/USD recovered from the 1.1807 support level after the mixed US job numbers were announced last Friday. In general, the US dollar still has strong expectations about the future near the date of raising the US interest rate before its rival, the European Central Bank, thinks to activate it.

The euro fell to a three-month low against the US dollar ahead of the release of better-than-expected US non-farm payrolls data for June, which was followed by widespread losses in the dollar exchange rates that had been strengthening for days before the release. While the euro rebounded along with other currencies late in the last session of last week's trading, it remained below the 55-week moving average against the dollar, which is around 1.1896. It will face increasing headwinds on the charts if the EUR/USD enters below this level due to the disappointing effect it can have on potential buyers of the single European currency.

The post-US employment rebound lifted the euro off the 78.6% Fibonacci retracement of its rally from early April lows, another important chart level providing support for the EUR/USD near 1.1824, but with the euro still lower their levels. It may only be a matter of time before this support is tested again if it is not overcome.

The US Department of Labor released a report showing the continued acceleration in the pace of US job growth in June. The report showed that US non-farm payrolls rose by 850,000 in June after rising by an upwardly revised 583,000 in May. Economists had expected employment to jump by about 700,000 jobs, compared to an addition of 559,000 jobs originally reported for the previous month.

After a dip in hiring last December, the pace of job growth rebounded to its highest level since last August. The stronger-than-expected job growth was partly due to significant increases in employment in leisure and hospitality, and public and private education, which added 343,000 jobs and 269,000 jobs, respectively. Notable job growth was also seen in professional and business, retail and other services, the Labor Department said.

Meanwhile, the Labor Department said the unemployment rate rose unexpectedly to 5.9 percent in June from 5.8 percent in May. The unemployment rate was expected to fall to 5.7%. The unexpected rise in the unemployment rate came as the labor force increased by 151,000 people, while the measure of domestic employment decreased by 18,000.

Commenting on the findings, Lydia Bosor, chief US economist at Oxford Economics, said: "While a host of labor supply constraints - including fear of the virus, unemployment benefits, childcare issues and early retirement - continue to constrain employment, these winds should ease. Gradually reverse over the coming months. She added: “However, a return to a pre-Covid environment will not happen quickly and we must be prepared for labor demand and labor supply in the second half of the year as the economy gradually returns to a new post-period. A normal pandemic.”

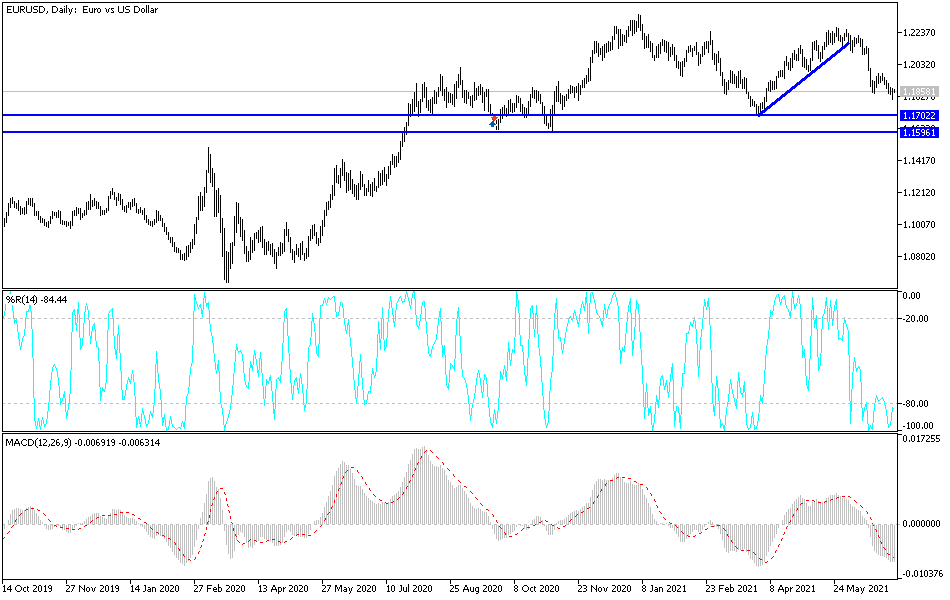

According to the technical analysis of the pair: On the daily chart, the price of the EUR/USD currency pair is still moving within its descending channel that was formed since the pair abandoned the psychological top 1.2000. Bearing in mind that the bears' move towards the 1.1780 support and below that will push the technical indicators towards oversold levels. Bulls' control of performance will not return without penetrating the psychological resistance 1.2000. I prefer buying the EURUSD pair from the support levels 1.1780 and 1.1690, respectively. In the midst of the US holiday today, the pair will interact with the announcement of the PMI reading for the services sector for the economies of the euro zone.