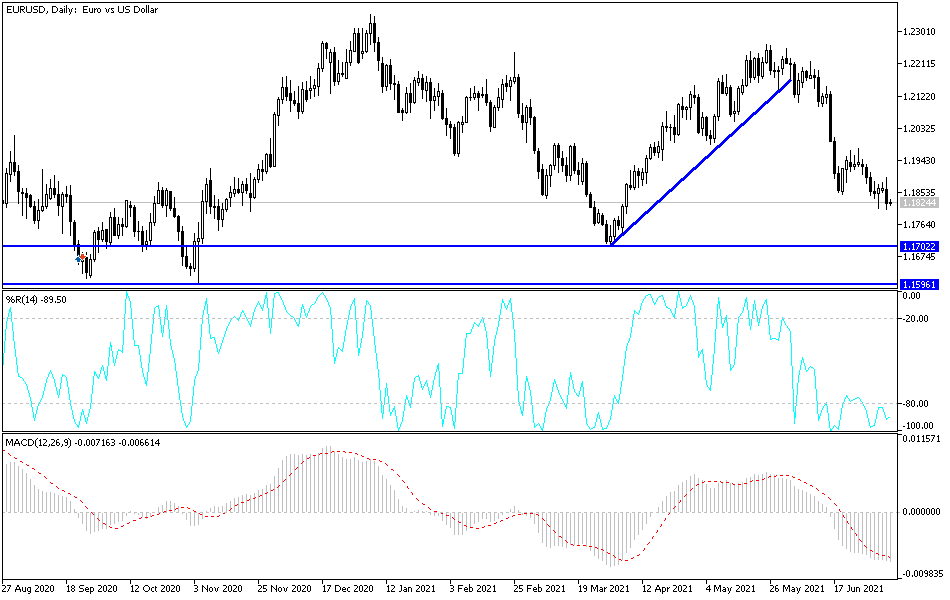

Prior to the minutes of the last meeting of the US Federal Reserve, the bearish pressure for the EUR/USD currency pair continues with losses to the support level 1.1806 before settling around the 1.1821 level at the time of writing the analysis. The pair tried to bounce back up to the resistance level 1.1895. The weak results of the economic data for the eurozone recently confirm the return of fears of the rapid spread of variables from the Corona virus. In addition, expectations are still increasing regarding the possibility of raising US interest rates.

The euro fell against the other major currencies, as the decline in German economic sentiment index for July and China's crackdown on technology companies weighed on the single European currency. Survey data from the ZEW - Leibniz Center for European Economic Research showed that German economic confidence fell to a six-month low in July. According to the results, the ZEW economic sentiment index fell sharply to 63.3 in July from 79.8 in the previous month. This was the lowest reading for the index since last January, when the result was 61.8 and also below economists' expectations of 75.2.

Meanwhile, Chinese regulators announced a cybersecurity investigation of US-listed companies such as Boss Zhipin and Full Truck Alliance affiliates on Monday. It came after the regulator ordered transportation services giant DiDi Global to be removed from mobile app stores in China, claiming it illegally collected users' personal data.

Inflation fears escalated in the wake of higher oil prices, as talks between OPEC and its allies collapsed on Monday.

Data released by European statistics agency Destatis yesterday showed that German factory orders fell unexpectedly in May, driven by weak foreign demand. Accordingly, manufacturing orders fell 3.7 percent month-on-month in May, reversing a revised 1.2 percent increase in April and confounding expectations for a 1 percent increase. Excluding core orders, new orders in manufacturing fell 3.7 percent. Domestic orders grew 0.9 percent, while foreign orders fell 6.7 percent in May. New orders from the eurozone fell by 2.3 percent, and new orders from other countries fell by 9.3 percent.

Compared to May 2020, the month hit hard by the pandemic, factory orders rose 54.3 percent after growing 80.2 percent the previous month. For its part, the German Economy Ministry said that incoming requests are still higher than the pre-crisis level. Commenting on the data, Ralf Solvin, chief economist at Commerzbank, said the economic recovery in the German economy would be driven primarily by a significant increase in private consumption, which differentiates it from previous highs.

According to the technical analysis of the pair: The return of the price of the euro currency pair against the dollar EUR/USD below the support 1.1800 will increase the control of the bears. The selling operations will return again to move towards stronger support levels and the closest to them are currently 1.1765 and 1.1680, taking into account moving towards it will push the technical indicators to strong oversold levels. On the upside, and according to the performance on the daily time frame, the EUR/USD pair still needs to breach the 1.2000 psychological resistance to be a stronger correction opportunity.

As for the economic calendar data today: The German industrial production rate and the French trade balance will be announced, then the European economic forecasts will be released. Then to the most important event, which is the announcement of the contents of the minutes of the last meeting of the Federal Reserve, which contained strong indications of the imminent date of tightening US monetary policy.