Bearish View

Sell the EUB/USD and add a take-profit at 1.1700.

Add a stop-loss at 1.1850.

Timeline: 2 days.

Bullish View

Buy the EUR/USD pair and add a take-profit at 1.1850.

Add a stop-loss at 1.1700.

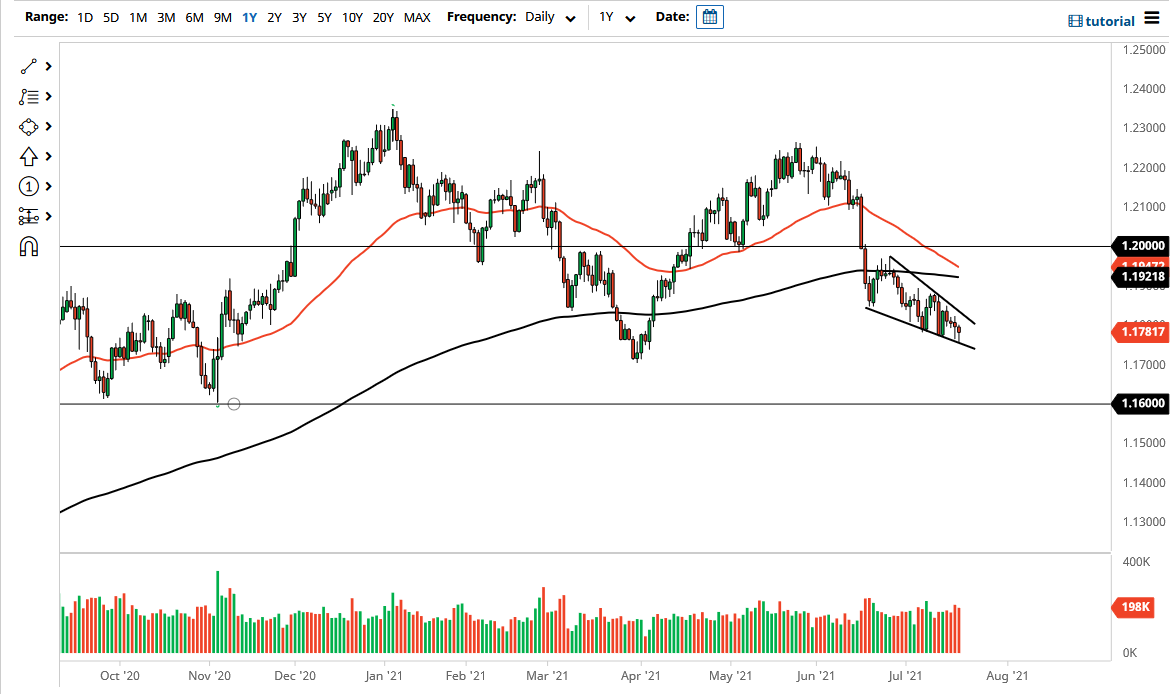

The EUR/USD is under pressure as investors shift their focus to the upcoming European Central Bank (ECB) decision. The pair is trading at 1.1772, where it has been in the past few days.

ECB Interest Rate Decision

With no major economic data scheduled today, most investors will be focusing on the upcoming ECB interest rate decision. In it, the bank is expected to leave interest rates unchanged. The bank is also expected to continue with its pace of its asset purchase program that is valued at more than 1.85 trillion euros.

The biggest focus of the meeting will center on the recently announced strategy. In the strategy, the bank decided to change its inflation target to 2%. Before that, the target was below, but close to 2%. As such, the EUR/USD will react to how the bank will clarify the change of strategy.

Still, the recent economic numbers and the overall stronger US dollar will likely give the ECB the latitude to maintain a dovish tone. The euro has already declined by more than 4% from its highest level this year and is trading at the lowest level since April.

Recent data showed that the Eurozone Consumer Price Index (CPI) declined from 2.0% in May to 1.9% in June. This inflation is substantially lower than the US and UK rates of 5.4% and 2.5%.

The EUR/USD is also reacting to the recent surge of coronavirus cases in most European countries. Countries like Spain, Italy, France, and Germany are seeing more COVID cases, putting their recovery at risk. In fact, travel between European countries is shaky and some countries are considering issuing fresh lockdown directives.

Meanwhile, traders are still reflecting on the latest US building permits and housing starts data. US building permits declined from 1.683 million to 1.59 million while housing starts rose to 1.643 million.

EUR/USD Technical Analysis

The EURUSD has been in an overall bearish trend recently. Along the way, it has formed a descending channel that is shown in blue. It is between this channel. It has also moved below the 25-day and 15-day moving averages while the Relative Strength Index (RSI) has been falling. Therefore, the pair will likely stick in this range on Wednesday as traders wait for the upcoming ECB decision. The key support and resistance levels to watch will be 1.1700 and 1.1850.