Last Tuesday’s EUR/USD signals were not triggered as there was no suitable price action that day at any of the key support or resistance levels which were reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered between 8am and 5pm London time today.

Short Trade Ideas

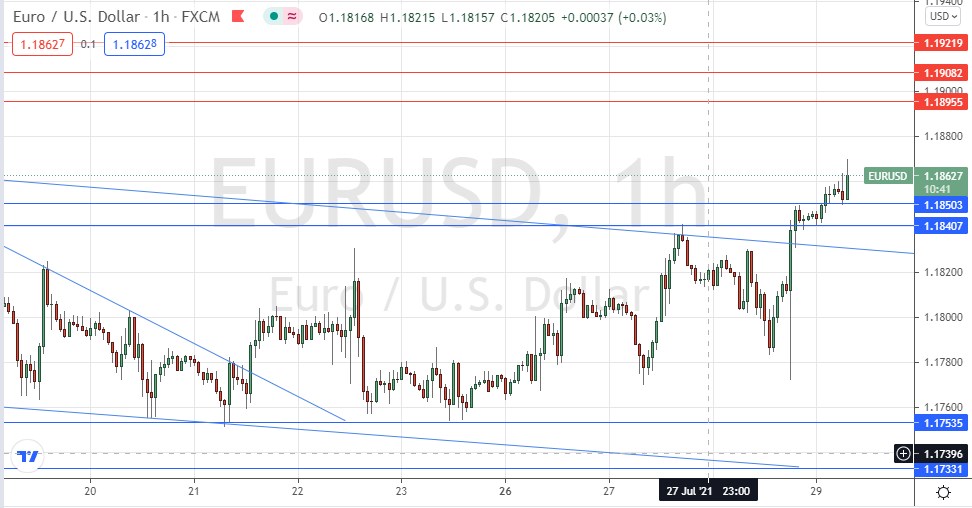

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1896, 1.1908, or 1.1922.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.850 or 1.1841.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Tuesday that we had a long-term wide bearish price channel which remained intact, with a long-term valid bearish trend which I thought may yet push prices to new lows. However, I noted that the pace of the downwards trend had become very slow, so I also thought that if the price did not close Tuesday in New York below 1.1766 I would start to doubt the long-term bearish trend, or at least expect it to proceed only extremely slowly.

This was a good call as the failure of the price to close below 1.1766 that day was an early signal that the bearish trend was failing.

We began to see firmer and firmer bullish rejections of the low of the bearish price channel, but yesterday’s FOMC release drove the US dollar lower almost everywhere and gave the final impetus required to produce a decisive bullish breakout out of the bearish price channel and above the pivotal former resistance level at 1.1850.

The euro and the British pound are probably the two strongest currencies right now. The way the price seems to be using the broken resistance at 1.1850 as new support should be very encouraging to bulls.

The price here has considerable room to move higher to 1.1895 without running into any resistance.

I will take a long trade if we get a bearish retracement back to 1.1850 or 1.1841 followed by a firm bullish bounce at either level.

Regarding the USD, there will be a release of advance GDP data at 1:30pm London time.

There is nothing of high importance oncerning the EUR scheduled for today.