Bearish View

Sell the EUR/USD and add a take-profit at 1.1740 (S1 of standard pivot point).

Add a stop-loss at 1.1850.

Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 1.1825 and a take-profit at 1.1900.

- Add a stop-loss at 1.1770.

The EUR/USD was little changed in the Asian session as traders weighed the strong US recovery and the upcoming European Central Bank (ECB) decision. The pair is trading at 1.1805, where it ended the week at last week.

Strong US Recovery

The US economy is firing on all cylinders as evidenced by last week’s data dump. Data published on Tuesday showed that the country’s Consumer Price Index (CPI) rose by 5.4% in June, the highest number since 2008. Without oil and energy, inflation rose by 4.2%, the highest level in 30 years.

Further data published on Thursday revealed that the number of initial jobless claims dropped in the previous week. And on Friday, data showed that the US retail sales rose by 0.6% in June. This number was better than the median estimate of a 0.1% decline.

The data showed that American consumers were continuing to shop in stores, restaurants, and online. This is a sign that the economy likely recorded a strong recovery in the second quarter. Economists polled by the Wall Street Journal (WSJ) revealed that the economy expanded by about 9% in Q2.

Therefore, with central banks like the Bank of Canada (BOC) and Reserve Bank of New Zealand (RBNZ) tapering, there is a high probability that the Federal Reserve too will do the same.

The biggest catalyst for the EUR/USD pair this week will be the upcoming ECB meeting scheduled for Thursday. The bank is expected to leave interest rates unchanged and possibly sound dovish. For one, the Eurozone’s CPI declined from 2.0% in May to 1.9% in June. This figure is below the new ECB target of 2.0%. The bank will also provide signals on when it expects to start tapering.

EUR/USD Technical Analysis

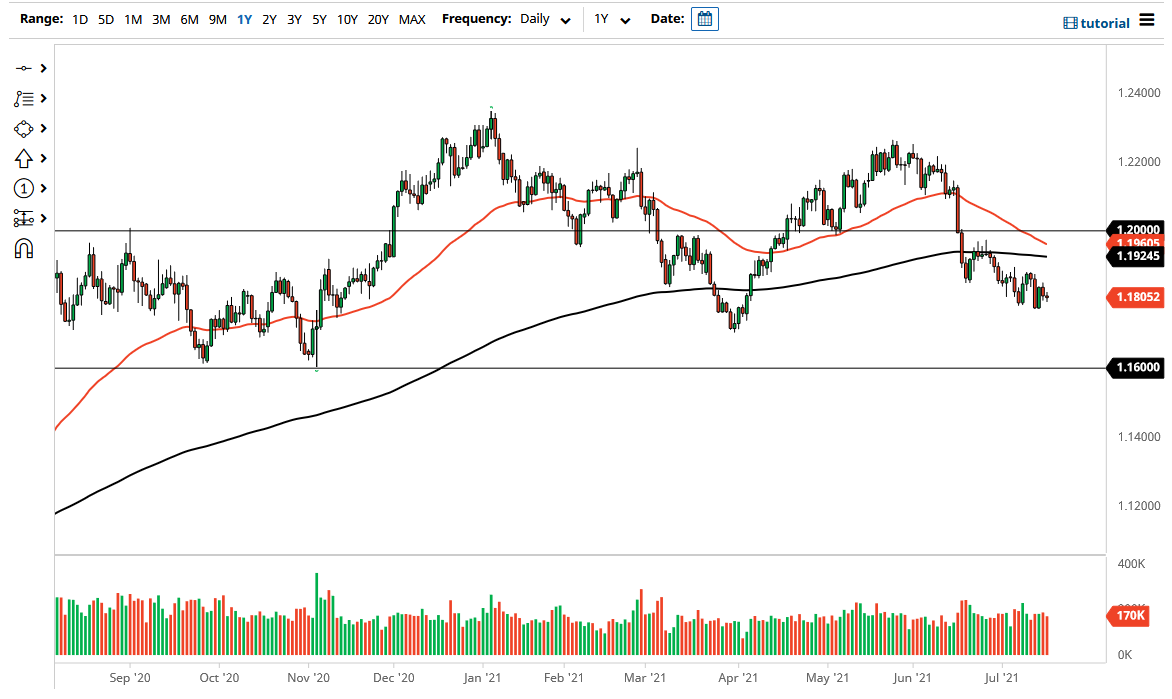

The EUR/USD pair has been in an overall downward trend in the past few weeks. On the four-hour chart, it has formed a descending channel that is shown in blue. It has also moved slightly below the 25-day and 15-day moving average (MA). It is also at the same level as the first support of the standard pivot points.

Therefore, the pair will likely remain in the current range for the next few days as traders wait for the ECB decision. The key levels to watch will be the second support of the pivot point at 1.1740 and the pivot point at 1.1850.