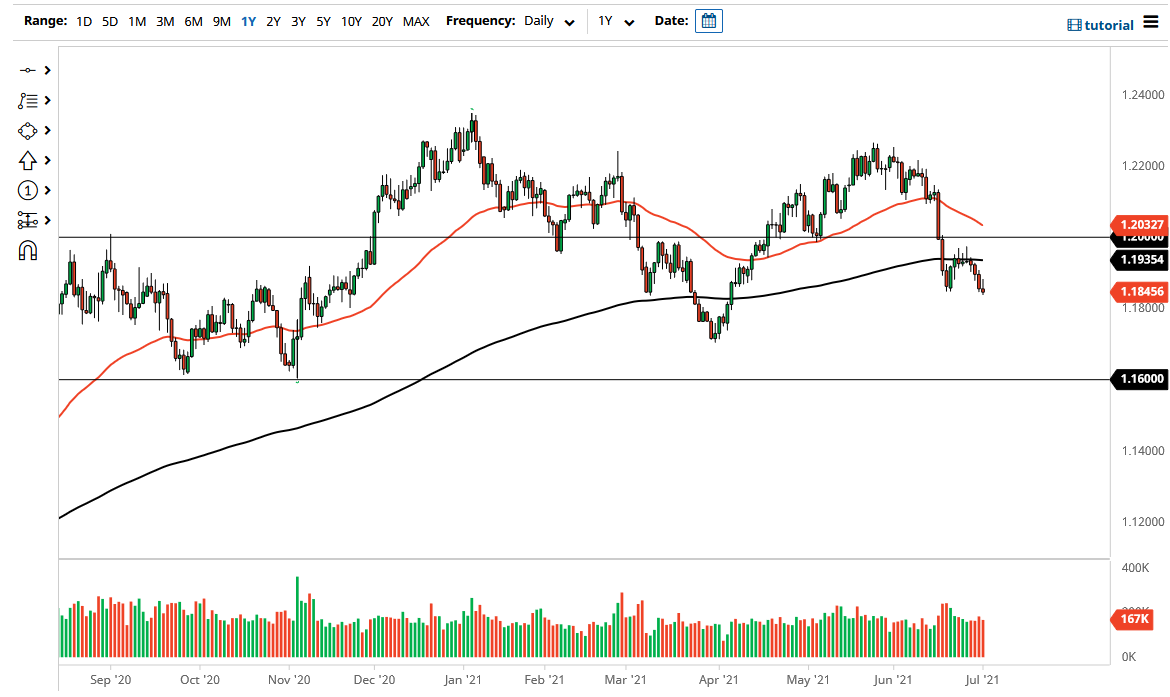

The Euro has given up early gains during the trading session on Thursday as we continue to see more negative pressure on the Euro, or perhaps a better way to look at it is that we continue to see people pile into the US dollar. That being said, the market has formed a massive “H pattern” that is now starting to kick off and as we head into the jobs number on Friday, it is very likely that we will continue to see a lot of volatility in this pair, but it certainly looks as if the downside is starting to pick up serious momentum.

If that is going to be the case, then I believe it is very likely that the Euro will go looking towards the 1.17 level, and then eventually the 1.16 level underneath where we had seen a lot of support. This is a market that looks very sick, and it now appears that the US dollar is starting to strengthen overall, not just against the Euro. If that is going to be the case, then the market is likely to see a lot of downward momentum, and you might be better served shorting other currencies against the US dollar but clearly it looks as if the market is ready to go much lower with the slightest little bit of pressure.

Obviously, there will be a lot of noise during the day on Friday as the jobs report comes out, but at this point in time I think it is also important to realize that Independence Day celebrations will be held on Saturday, meaning that a lot of traders probably will be looking to much at their charts once the jobs number is released and we get through the first hour of trading. With that in mind, I anticipate that we continue to see more downward pressure and that rallies should be selling opportunities. Whether or not we get some type of major breakdown might be a completely different story, but ultimately, I think we are going to be drifting lower over the longer term and therefore it is worth looking at rallies with suspicion unless of course we can recapture the 1.20 handle above. Currently, we are nowhere near doing that and therefore I am not looking to buy the Euro.