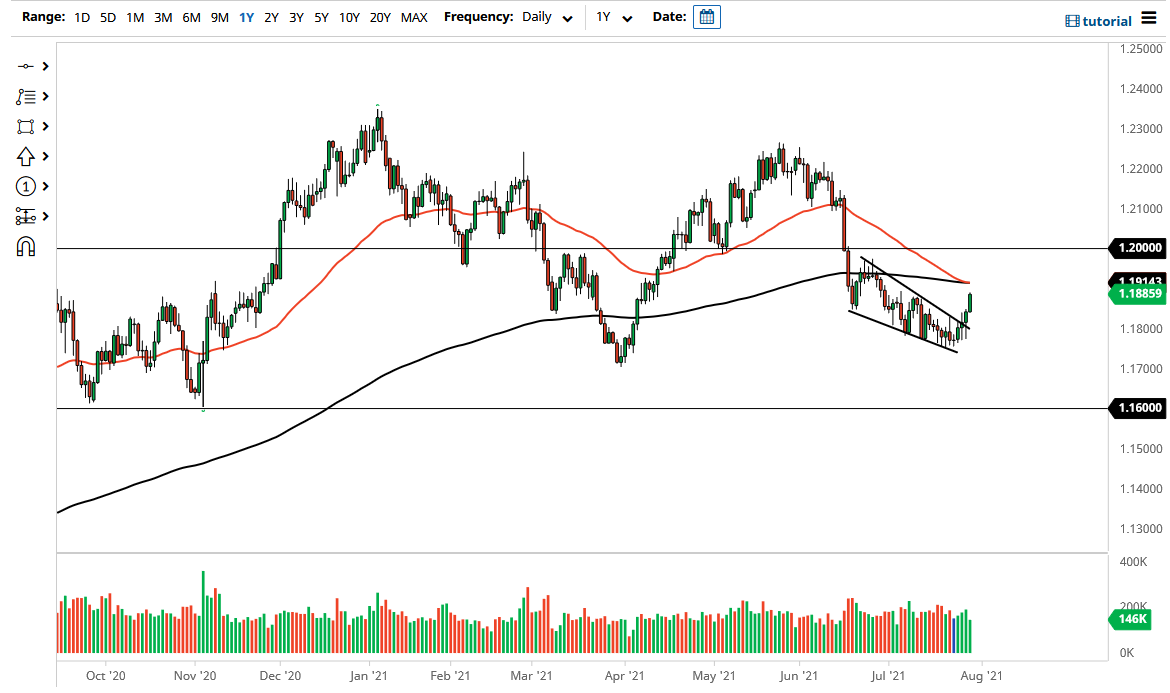

The Euro has broken above the top of the candlestick for the trading session on Wednesday during the Thursday session, as it is now starting to approach the 200 day EMA. Ultimately, this is a market that has a lot of noise just above, as we are recently breaking out of a falling wedge. The falling wedge measures for a move towards the 1.1950 region, perhaps even as high as the 1.20 handle, which is a large, round, psychologically significant figure and an area that a lot of people will pay attention to. Because of this, I think that although we are probably going to rally, it is only a matter of time before we get signs of exhaustion that we consider shorting.

It will be interesting to see whether or not the market is going to be able to break above the “death cross” that we are in the midst of making, and if we can exhaust ourselves in the process, it would make a typical shorting opportunity. I suspect that it will be difficult to break above the 200 day EMA on a Friday, as we run out of time for the week to continue going higher. It will be a very bullish sign and if we do, due to the fact that it would show that people might be looking ahead with a certain amount of comfort, as they go into the weekend “risk on.”

If we do pull back from here, the 1.18 level would be an area that I think a lot of people would pay attention to as it was the scene of the breakout, and therefore one would assume that there are a certain amount of buyers in that general vicinity. With that in mind, I would be very cautious about trying to get too cute with this market, but one would think that we probably have a little further to go to the upside before we run into serious resistance. I suspect Friday will initially start a very bullish, perhaps selling off later in the day as traders cover their positions heading into the weekend. Just above, the 1.20 handle for me is a major turnaround point, because if we can break above there it is likely that we go looking towards the highs yet again.