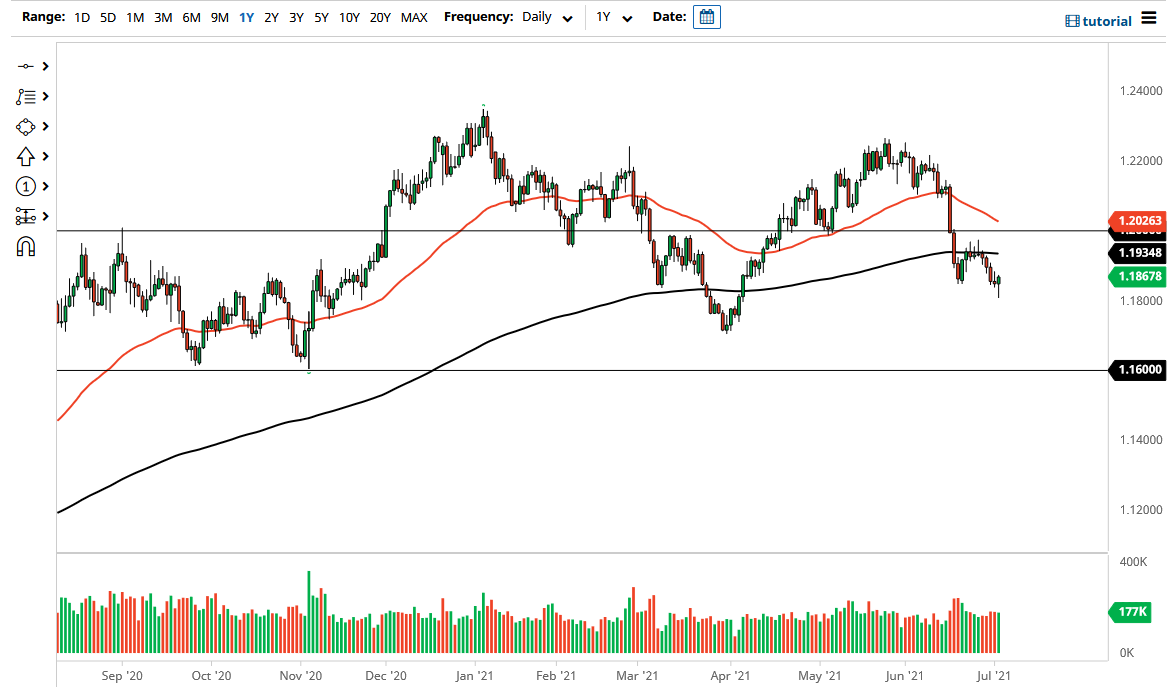

The euro initially fell during the trading session on Friday as the jobs report came out the United States. That being said, the market turned around to show signs of strength as we formed a major hammer. The inverted hammer during the session before suggests that we have a lot of noise just above. If we can take out the inverted hammer to the upside, then we more than likely will go looking towards the 200-day EMA.

The 200-day EMA is sitting at the 1.1934 handle, which is where we have seen a lot of selling pressure previously. If we cannot get above there, then we will have failed to make a new “higher high” in an attempt to re-establish the bullish pressure. At this point, it will be interesting to see how things play out, due to the fact that we initially formed a massive “H pattern”, which is a very bearish sign. If we break down below the Friday candlestick, that could open up a bit of a “trapdoor” to the downside.

Underneath, if we break down below the 1.17 handle, then it is likely that we will go looking towards the 1.16 handle after that. To the upside, if we can take out that most recent high, then we will challenge the 1.20 handle. This has been a massive turnaround during the trading session on Friday, but you have to wonder whether or not it is liquidity-driven or not, as we are heading into the Independence Day holiday and almost nobody would have been trading late during the trading session on Friday. With that being said, we are looking at a market that is trying to save itself, but we will not get clarity until Monday or Tuesday.

If we were to take out the 1.20 handle to the upside, then we will probably go through the 50-day EMA and go looking towards the 1.2125 handle, which happens to be where we broke down from. I think we will simply chop back and forth which is typical for this pair, as the euro attracts a lot of high-frequency trading, meaning that it has nowhere to be in the short term, but longer term it certainly looks threatened.