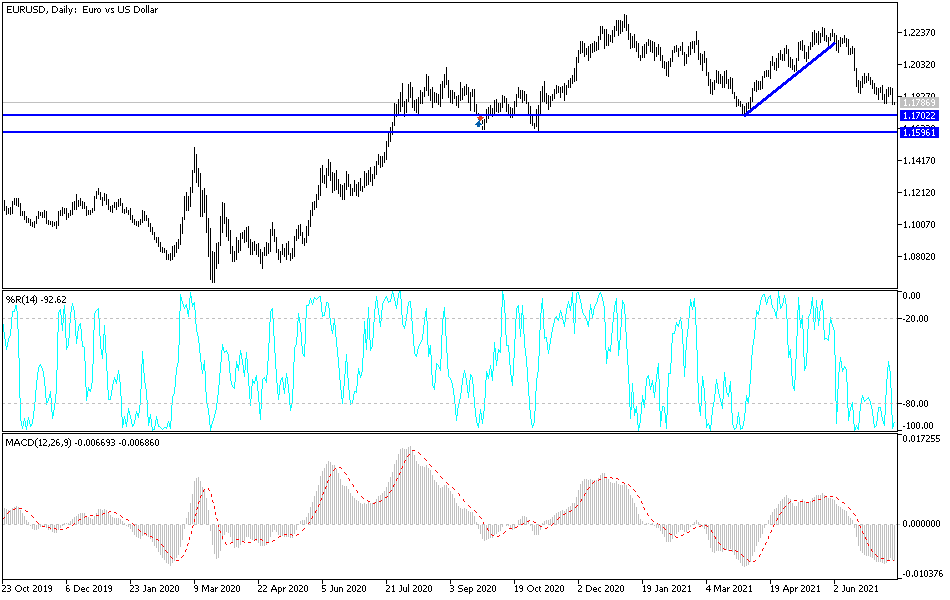

The euro got hammered during the trading session on Tuesday to break down below the 1.18 level yet again. This is a market that has seen a lot of bearish pressure as of late, and the US dollar certainly looks as if it is ready to make a huge move to the upside in general. It is not only in this market, but the US Dollar Index is threatening a massive uptrend line, something that could come into play during the trading session on Wednesday. If the US Dollar Index breaks the 93 handle, the euro is going to be absolutely smoked.

On a breakdown in this pair, we will go looking towards the 1.17 level, followed by the 1.16 level. The fact that the US dollar is closing at the absolute bottom of this candlestick suggests that we have more momentum to the downside just waiting to happen, and it should be noted that we have recently seen a huge “H pattern”, one of my favorite patterns to start shorting. Ultimately, I do believe that this market probably will probably go looking towards the 1.16 level underneath, an area that has been massive support previously. At this point, I think it is very likely going to be a scenario where rallies will be faded, and I do not even necessarily have a scenario in which I'm willing to get long of this market anytime soon.

To the upside, we would at the very least have to break above the 200-day EMA to get long. I very seriously doubt that is going to happen anytime soon, and I believe that the candlestick from the session on Tuesday is simply yet another “nail in the coffin” when it comes to the euro. The 50-day EMA is reaching towards the 200-day EMA, getting ready to form the so-called “death cross.” After that, we have the 1.20 handle offering resistance as well. I hear a ton of noise between here and there to cause issues. Looking at this chart, the markets continue to look very vulnerable and threatened, and if we continue to see yields in America rising, it is very possible that those rising yields may continue to attract more inflows when it comes to the currency markets.