The euro rallied significantly during trading session on Wednesday to recover most of the losses on Tuesday. That being said, if the market cannot break above the top of the candlestick, it is very likely that we would see sellers come back into this pair. The market has closed at the top of the candlestick, which is a bullish sign. However, you can also say that the Tuesday candlestick closed at the very bottom of the range, which is a very bearish sign. That in and of itself is a bit of a microcosm for what is going on right now, as traders have no idea what to do next.

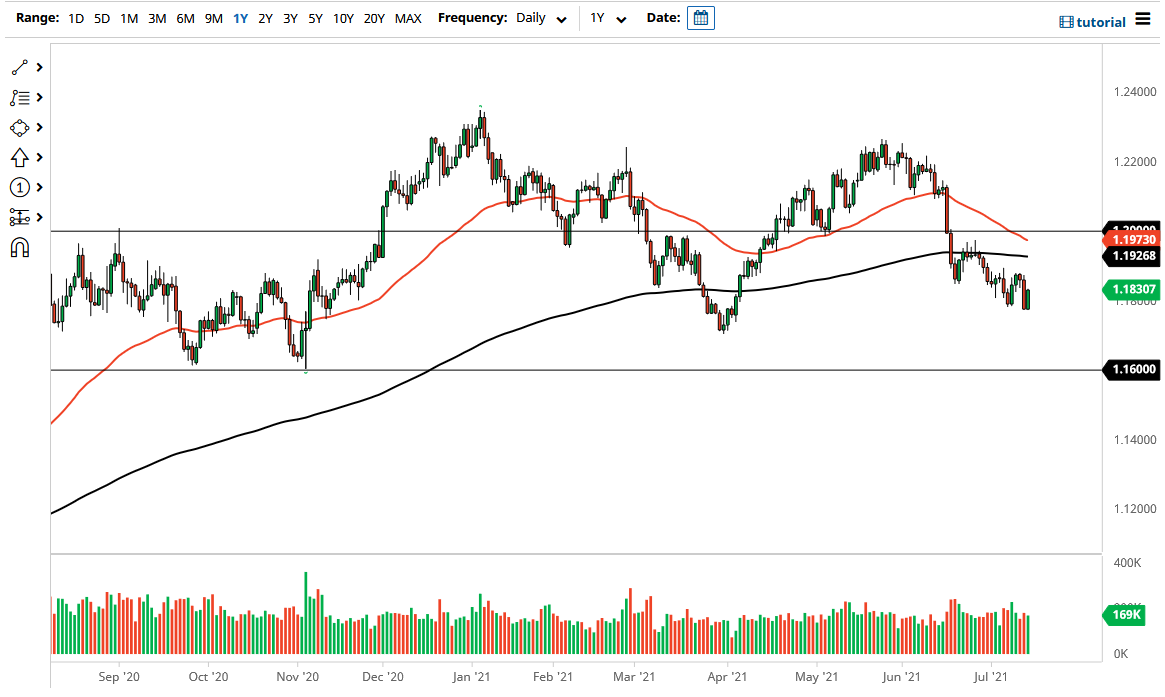

If we can break down below the lows of the last couple of days, which I see as the 1.1775 handle, the market then is likely to drop down to the 1.17 handle, perhaps even down to the 1.16 level underneath. With that being the case, I think that we could add to shorts as we go long. As for buying, I think it is going to be very difficult to do anything of that sort, as we are most certainly going to continue to see resistance above at the 200-day EMA, currently sitting at the 1.1925 handle. After that, the 1.20 level also offers resistance, and it is worth noting that the market has the possibility of forming a “death cross” as the 50-day EMA is starting to reach down towards the 200-day EMA.

It is worth noting that we still have the “H pattern” in effect and are nowhere near trying to take out the bottom of that pattern. Ultimately, this is a market that I think will continue to see a lot of downward pressure at the first signs of trouble. With this, you should also pay attention to the 10-year note, because if yields start to move rapidly, that typically means either a run towards safety, or perhaps people looking to own dollars due to the fact that there is more in the way of yields offered. (This basically comes down to the rate of change more than anything else.) This is a market that I think will continue to find sellers on signs of exhaustion.