The euro rallied ever so slightly during the trading session on Monday, which was a bit interesting considering that it did not even have the influence of Wall Street working against it. After all, most of the gains for the euro last week on Friday had to do with New York, and not European or Asian traders. Yes, we did form a nice-looking hammer for the session on Friday, but there was absolutely no follow-through, despite the fact that there would be no influence from American traders.

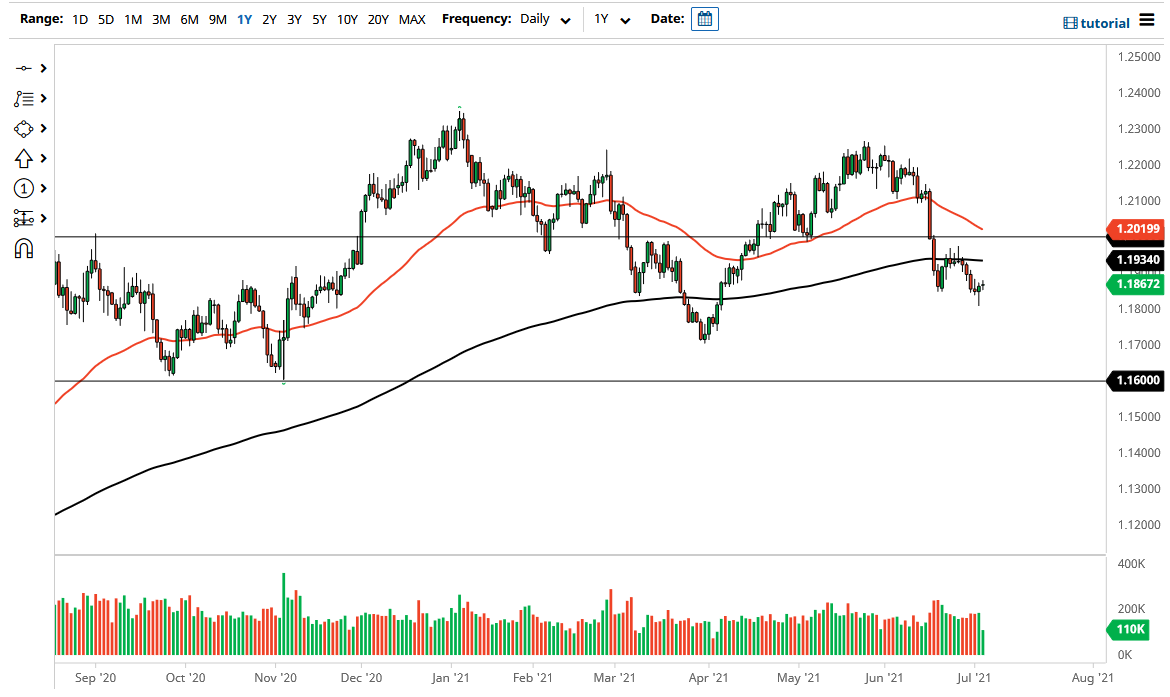

With that being the case, we may get a bit of a rally, but I think we have already seen that there is not much in the way of momentum. The 200-day EMA currently sits at the 1.1934 level and is starting to drift ever so slightly. At this point, I do not think that we are going to be able to break above the 200-day EMA in the short term, so rallies will probably be sold into. I would also point out that there is a massive “H pattern” on this chart, suggesting that perhaps we have further to go to the downside. When you look at the Thursday candlestick, it was an inverted hammer, so it does make sense that we have a lot of back and forth in this general vicinity ahead of us.

Breaking down below the bottom of the hammer from the Friday session would be very negative, and would open up the possibility of a move down to the 1.17 level, maybe even the 1.16 level after that. As far as rallying is concerned, we need to break well above the 200-day EMA to be convincing, and even then, you would have to contend with the 1.20 level above there, an area that will almost certainly cause a certain amount of resistance. It is breaking above that level that would open up the euro to a big rally. Right now, it certainly looks as if we are probably going to be more sideways than anything else, perhaps with more of a negative tone. Because of this, I think it is probably easier to simply fade short-term rallies that show signs of exhaustion, as the US dollar is starting to pick up a bit of strength against multiple currencies.