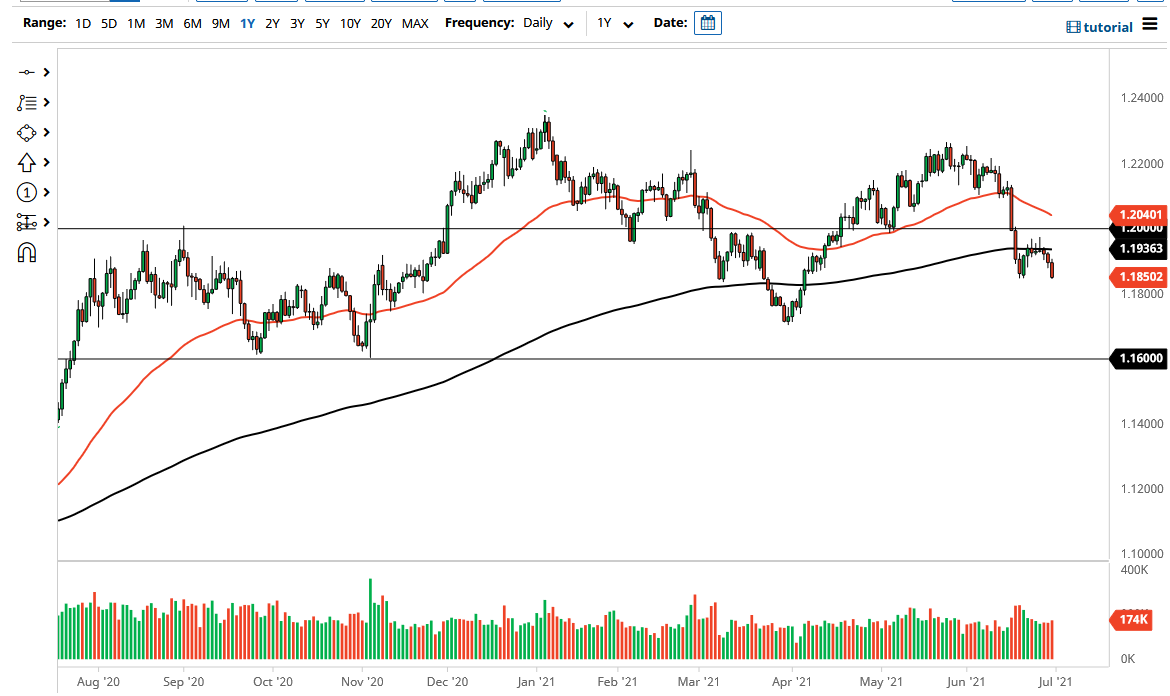

The euro struggled again during the trading session on Wednesday as we have reached towards the 1.1850 level. This could open up fresh new selling, so this is most certainly worth paying attention to. There is also an “H pattern” that has formed, with the 200-day EMA offering significant resistance. This all bodes very poorly for the euro and does suggest that we are going to continue to see the US dollar strengthen against the euro and many other currencies around the world.

At this point, the market looks like it is ready to break down below this little support area and go looking towards the 1.17 level, followed by the 1.16 handle after that. The 1.16 level is an area that has been important more than once, so this is a market that will probably attract a lot of attention in that general vicinity. A breakdown below there then could kick off a much deeper correction, but at this point I think what we are likely to see is at least a run towards that area.

On the other hand, if we turn around and break above the 1.20 handle, that would be a very bullish sign and could send this market towards 1.2150 level. That is an area that will attract a lot of attention in general, as it is where we have seen the market selloff recently, so that has a certain amount of importance attached to it as well. To even get there, we would need to break above the 50-day EMA to make that happen, so that in and of itself might attract a lot of buyers as well.

To the downside, the 1.17 level is where we had bounced from previously, so that is why I suggest that that might be the initial target. Breaking down below that would make a large “lower low”, so that is something worth keeping in the back of your mind as well. The US dollar itself has been rallying against almost everything else, so the euro probably will not be any different now anyway. The size of the candlestick was relatively convincing, although we did bounce ever so slightly at the end of the session.