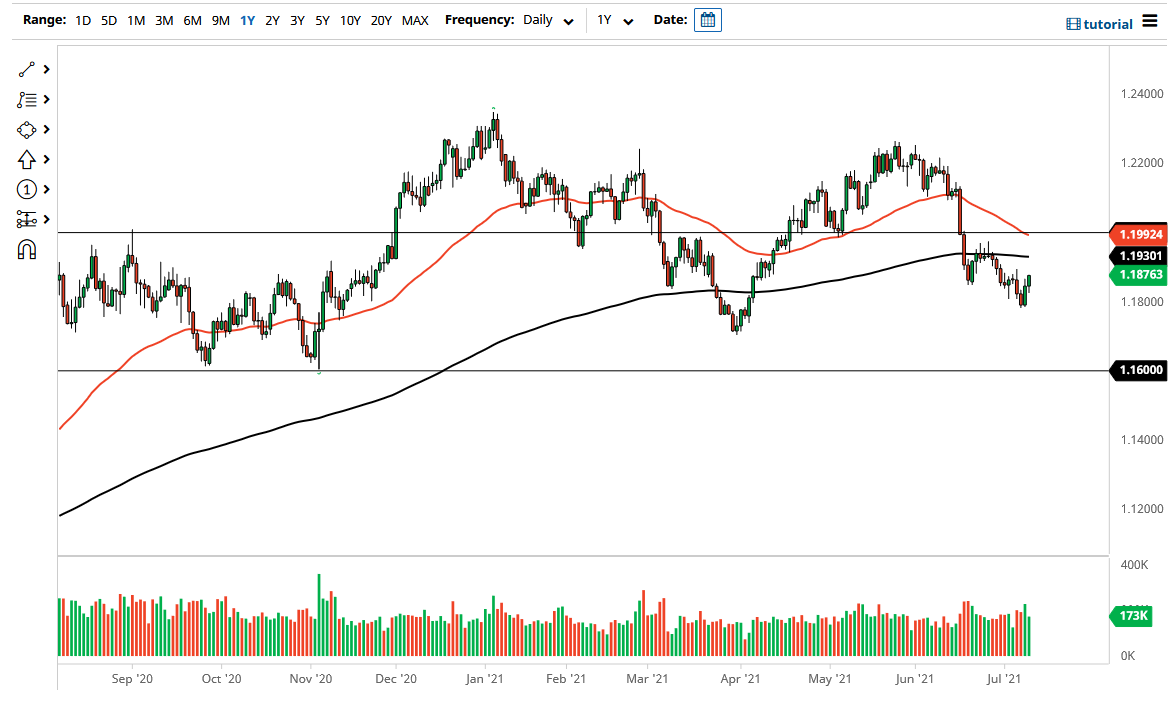

The euro rallied significantly during the day on Friday to close just below the 1.19 level. Although this has been a very bullish move, one still has to wonder whether or not the market has enough momentum to continue going higher. I think that we are going to run into a bit of trouble above, especially near the 200-day EMA. One of the biggest indicators that you can look at right now is going to be the bond market, and if we continue to see money running into that market, it is very likely that we would see this pair fall from here.

Underneath, the 1.18 level offers support, but if we break down below there, it is likely that we could go down to the 1.17 level, followed by the 1.16 level. The 1.16 level underneath is a massive support level, and an area where we have seen the market bounce from previously. At this point, I do not trust this rally, although I do suspect we might get a little bit of follow-through. I am looking for signs of exhaustion that I can get involved in, but if we were to break above the 1.20 handle, then the market could go looking towards 1.22 level. That is an area where we have seen a lot of selling pressure previously, so it would make sense that we would see pressure there again. Nonetheless, I think this will continue to be a very choppy and erratic market, but when you look at the action over the last couple of weeks, we have clearly seen a lot of weakness. While we have seen buyers, the reality is that we still have even made a “higher high.” In fact, a lot of the movement on Friday may have simply been short covering heading into the weekend.

I still favor the downside, but I need to see some type of exhaustive candlestick in order to get involved. I will take this on a day by day basis, as it could give me a little bit of a “heads up” as to where we are going. Because of this, I think this is a market that will continue to see choppy volatility, and it looks like it is only going to get worse just above current trading levels.