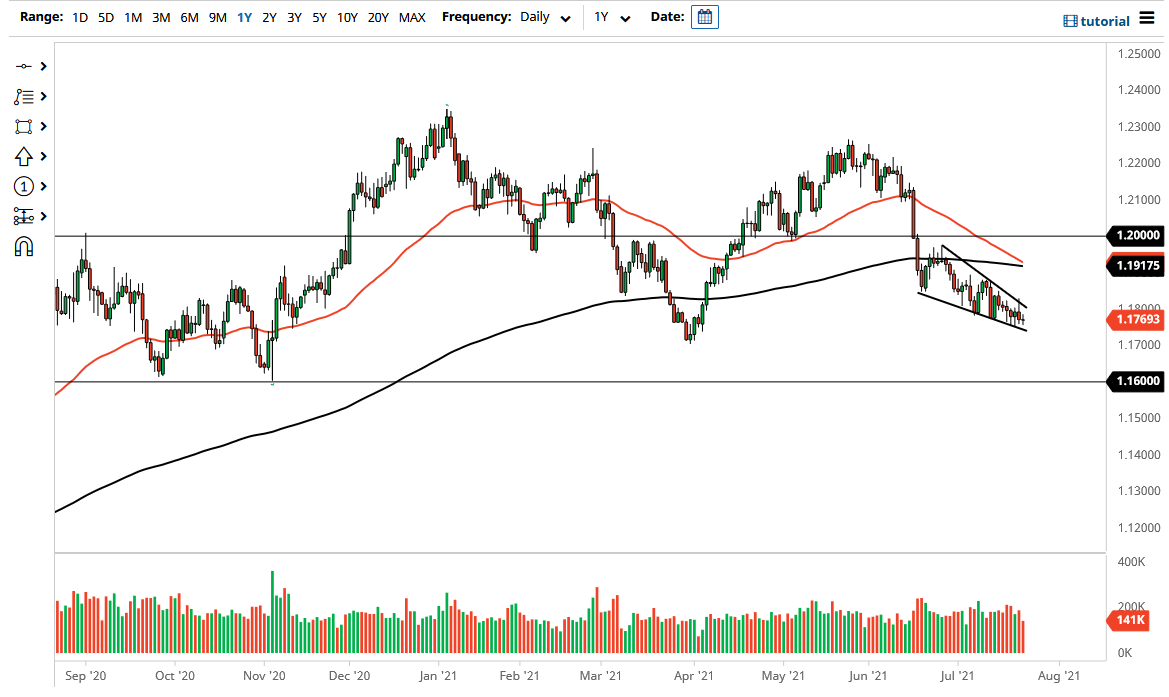

The euro fluctuated during the trading session on Friday as we continue to see this market slide down a falling wedge. The question now is whether or not we can break out to the upside and take off for a bigger move. At that juncture, it is likely that the market would go looking towards the 200-day EMA which is sitting just above the 1.19 level. That being said, the 200-day EMA is getting ready to be crossed below with the 50-day EMA to form the so-called “death cross.”

Another thing worth paying attention to is that the top of the falling wedge is roughly in the same area. That being the case, it is relatively obvious that the market has been struggling for a while, so I do think that we could see this market drift even further, especially as the ECB has stated that the central bank is not going to be cutting back on bond purchasing anytime soon as we continue to see coronavirus concerns in the European Union. In fact, the Germans have just introduced travel restrictions on a couple of their neighbors, which does not bode well for the euro in general.

If we do break down below here, it is very likely that the market could go looking towards 1.17 level, and perhaps even down to the 1.16 level. The 1.16 level has been significant support more than once, so I think it would attract a lot of attention. Pay close attention to the yields on the 10-year note, as it could also give you a heads up as to where we are going next. If the US dollar gets a boost due to bond buying, it is possible that we could see the euro suffer as a result. Furthermore, German bonds are negative yielding, while the US notes offer a small but real return.

Ultimately, this is a market that I think would possibly have a move to the upside before sellers would come back in, and I think that would be a nice opportunity to get involved. On the other hand, if we simply drift below the bottom of the falling wedge, then I would be more than willing to short there as well. Regardless, I do not like the idea of buying at this point.