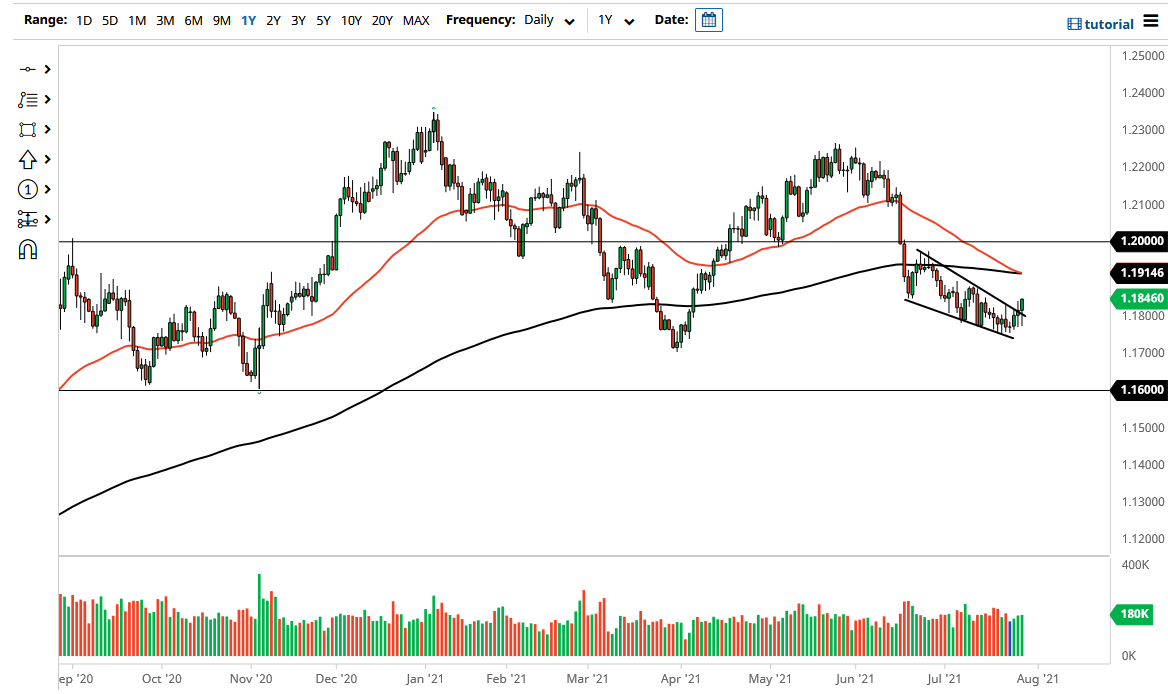

The euro initially pulled back during the trading session on Wednesday, but as Jerome Powell got done with his press conference, it became obvious that the US dollar was going to get hit. Now that we have broken above the top of the falling wedge, it is technically a bullish sign. It is very likely that we will go looking towards the 200-day EMA, where we are starting to form a bit of a “death cross”, which suggests that we have longer-term downward pressure. That being said, that indicator quite often is a bit late, so it is likely that we would have some people pay attention to it, but others will simply ignore it.

The technical pattern of the “falling wedge” typically means that the market is ready to go towards the top of that pattern. In other words, we could go to the 1.20 handle above, which is a large, round, psychologically significant figure. That is an area that I think would offer quite a bit of psychological support and one that has previously been massive resistance. That large figure will cause a lot of headlines as well. With that being the case, I think it is only a matter of time before we try to get some type of direction at that area.

If we were to turn around and fall below the 1.18 handle, then it is likely that we could continue the overall downtrend. I think a short-term bounce makes sense, as Jerome Powell went out of his way to essentially talk about how the Federal Reserve has not seen enough inflation to tighten monetary policy, so we may see a little bit of a beat down when it comes to the greenback over the next several days. Nonetheless, I do think that it is only a matter of time before we have to make a bigger decision, but right now I think we are more likely than not to see a short-term bounce that a lot of traders will take advantage of to start shorting again at the first sign of trouble down the road. Ultimately, it is a short-term trade, but perhaps a longer-term short.