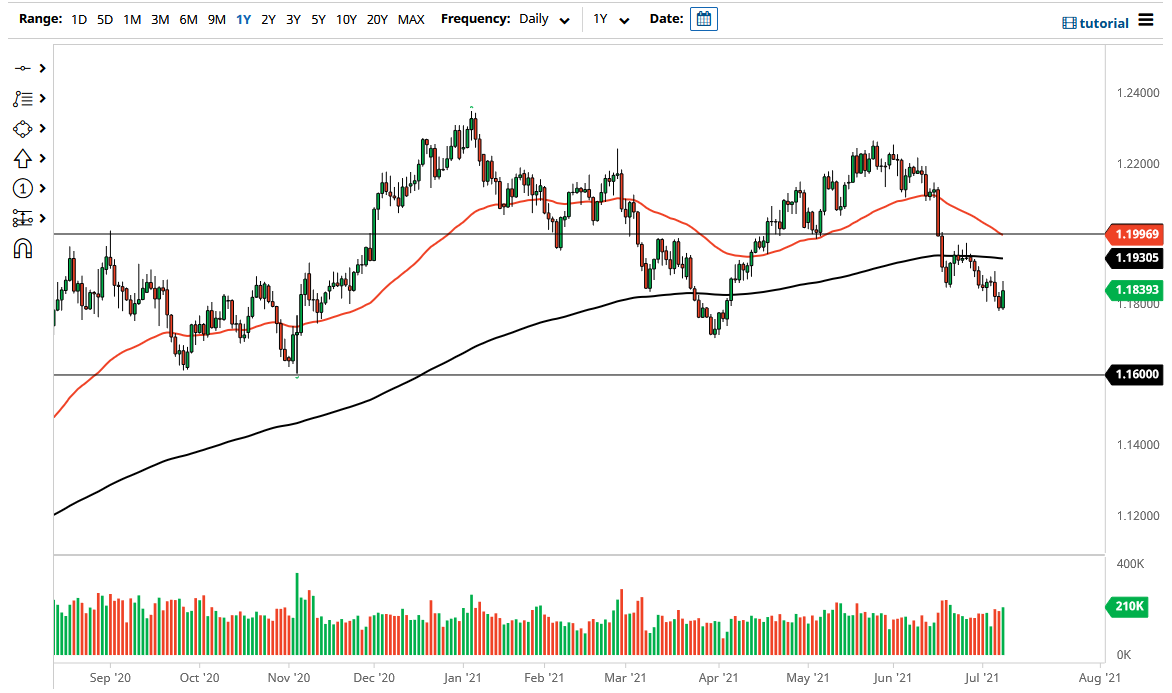

The Euro has recovered a bit during the course of the trading session on Thursday to reach towards the 1.1850 level. That is an area that has been important more than once, and as a result it is likely that we could see a bit of selling pressure. In fact, we have seen a little bit of selling pressure at the end of the day, so it is likely that we continue to see more of a downward move, despite the fact that Christine Largarde suggested that 2% inflation was the guide for ECB actions.

We have bounced quite nicely, but it is worth noting that there has been a significant amount of “risk off trade” during the trading session and that will eventually find its way we did this market as well. In fact, if it were not for the speech during the trading session, it is very possible that we may have simply fell from here. From a longer-term standpoint, I look at the 200 day EMA above as significant resistance, especially near the 1.19 level as that also would attract a certain amount of attention by itself.

I think that this will remain a “sell on the rally” type of scenario going forward. I would anticipate that the market would go looking towards the 1.18 level again, and then eventually the 1.17 level. After that, then we probably go looking towards 1.16 level where I see a significant amount of support from a structural standpoint, so that could be the target longer-term.

As far as buying this market is concerned, I really do not have any interest in doing so until we break above the 1.20 handle, as it would clear the 200 day EMA, the 50 day EMA, and of course the next large, round, psychologically significant figure. If we do get above there, then it is possible we pick up another 200 pips or so, but I do not think that happens anytime soon. After all, we continue to see a lot of money flow into the bond markets in America, which of course require US dollars. As long as that is going to be the case, this is a market that I think continues to see lots of shakiness, and then eventually a sustained move, more likely than not to the downside.