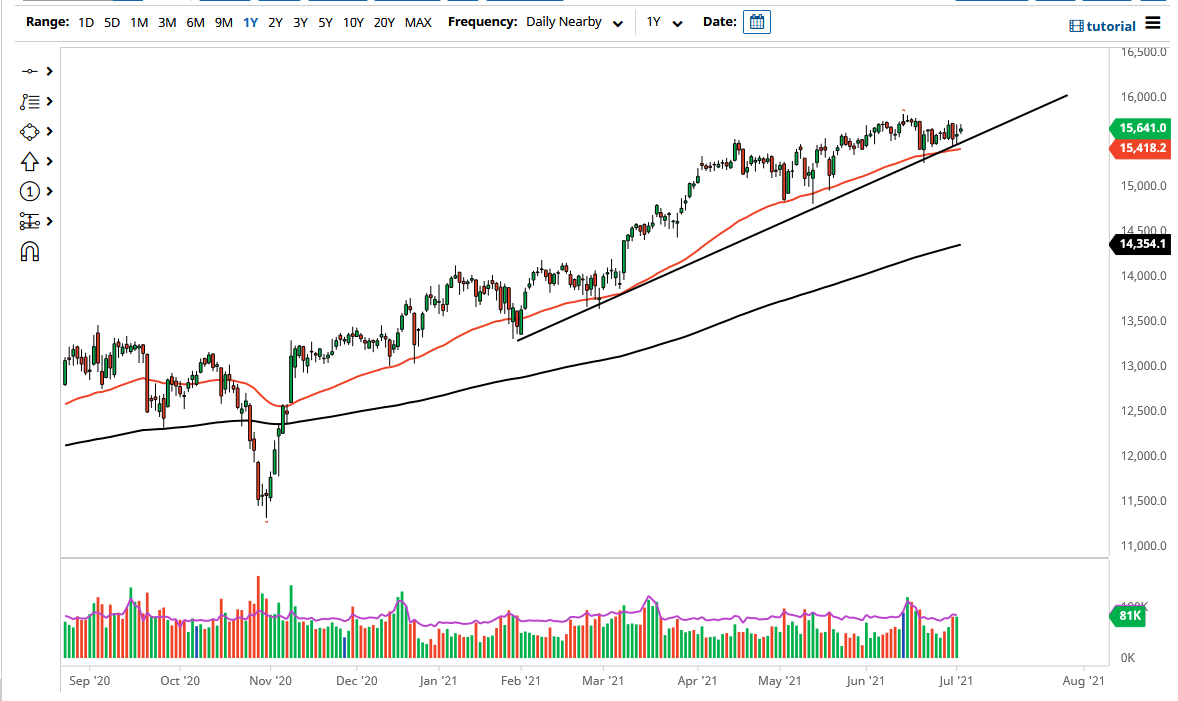

The DAX Index gapped higher to kick off the trading session on Friday, but then went back and forth to show signs of hesitation. The uptrend line continues to offer support, right along with the 50-day EMA, which is sitting just below it. With that being the case, the market is likely to continue to hear a lot of noise underneath that could lift this market, and you should also pay close attention to the overall risk appetite as well, because it certainly will be felt in this market.

The German index continues to attract a lot of attention due to the reopening trade, as the German economy is full of companies that export major industrial products around the world, so in and of itself, it is a play on the large industrial reopening situation. With that being the case, I think that the DAX will continue to look as if it is offering value.

If we did break down below the 50-day EMA, then the market could go looking towards the 15,000 level. The 15,000 level is a large, round, psychologically significant figure. That will attract a certain amount of attention itself, so I think it is worth paying attention to. The 200-day EMA is currently reaching towards the 14,500 level and rising. Because of this, if we were to break down below the 200-day EMA, then the market could fall rather significantly, but I think we would see that in other markets as well, so it would be a major “risk off type of scenario.

Expect a lot of noise, but I do think that it is only a matter of time before we go higher, and that is the plan. I think that we are probably going to be aiming for the 16,000 level, which is a large, round, psychologically significant figure and an area that we should be paying close attention to. Ultimately, we are in an uptrend, and that is essentially what matters the most; so until that changes, you can only be a buyer of dips. This will be especially true if we continue to see the reopening trade attract a lot of attention as the world comes back from the coronavirus.