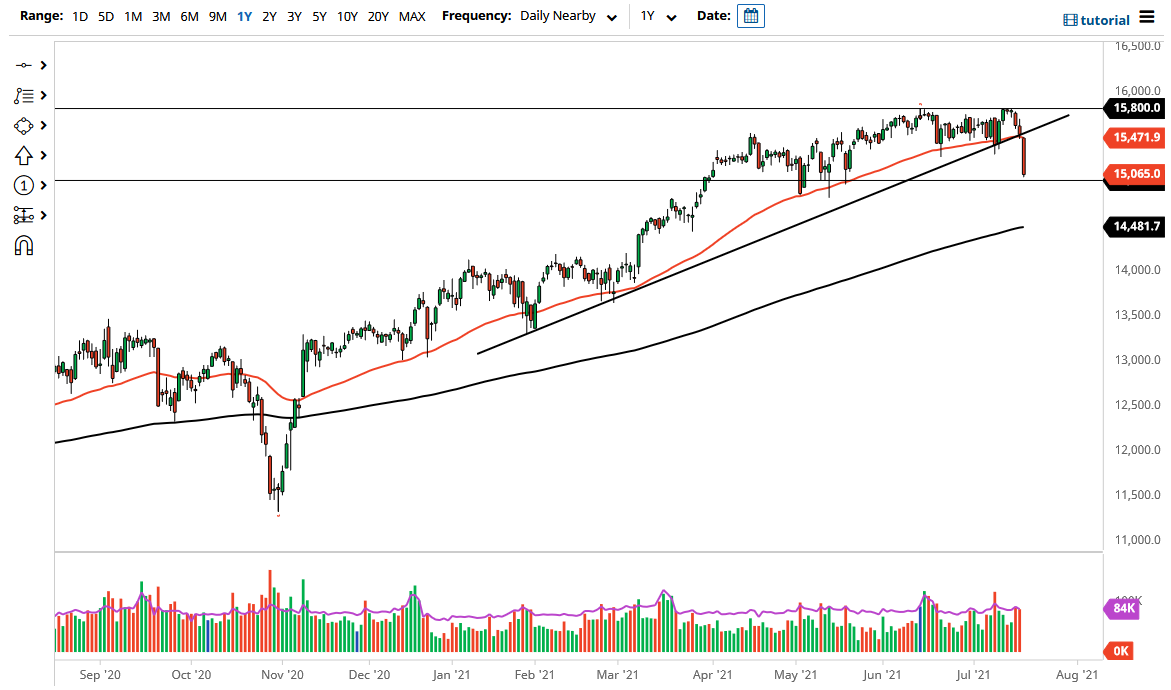

The DAX broke down significantly during the trading session on Monday, breaking below the 50-day EMA rather easily. At that point, the market then fell to plunge towards the 15,000 level, an area that has a certain amount of psychology attached to it as well as previous support. The 50-day EMA had been supportive at the 15,000 level as well, so that gives us yet another reason to think it could hold based upon previous actions.

Nonetheless, this to me is a very negative sign and it does suggest that perhaps we are getting ready to start something bigger. I am not necessarily calling for some type of massive bear market, just that it would not be surprising at all to see the DAX break down below the 15,000 level, reaching towards the 200-day EMA underneath which is currently at the 14,481 level. I believe the market is one that is going to be very difficult to buy, because a lot of people are concerned about the idea of the global economy slowing down due to the Delta variant. The previous uptrend line would be a significant resistance barrier, so I think that short-term bounces at this point will probably continue to be sold into.

The Delta variant shutting down economies in places like Indonesia and Australia is particularly bad for Germany, because some of the biggest companies that are in the DAX are major exporters of industrial components, and if we get the slowdown in the reopening trade, that is going to be felt by these massive companies.

At best, I believe that the market is likely to see a little bit of sideways action in order to build up a short-term basing pattern. I think it is going to be difficult to see whether or not we could form enough momentum to turn around, but the first thing that needs to be seen it is the ability to slow down some of the massive losses that we have seen. Indices around the world all fell, so I do think that they will probably move in a certain amount of synchronicity anyway, so pay attention to other indices such as the Nikkei, FTSE, etc.