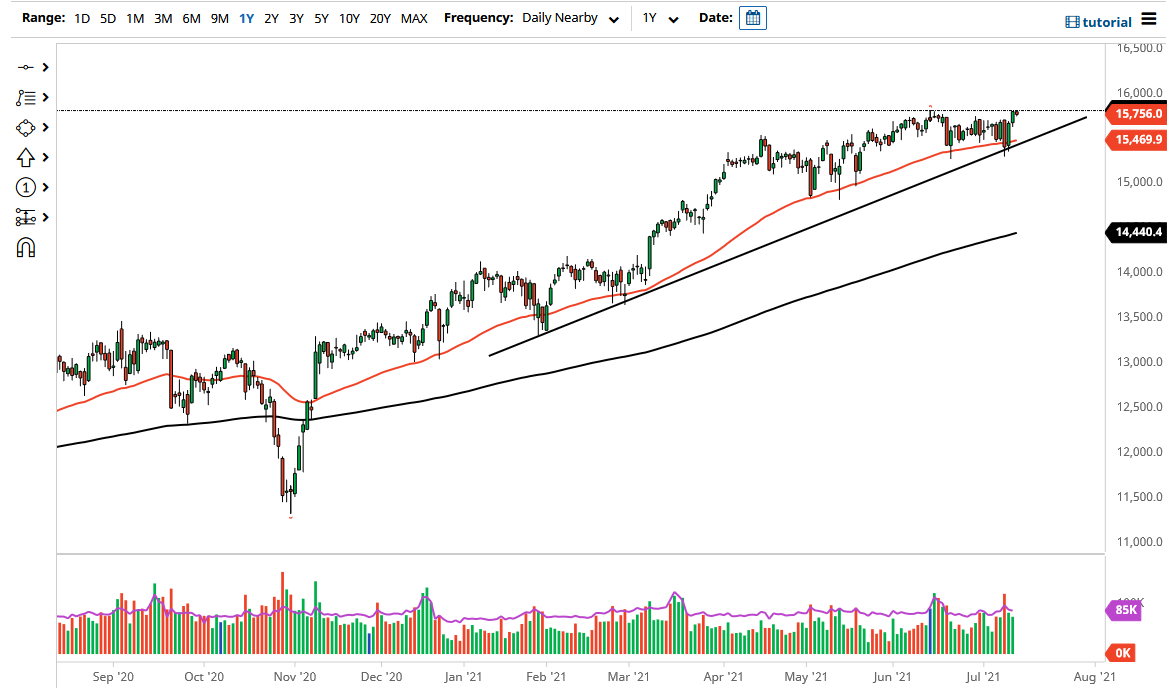

The DAX Index did pull back a little bit during the trading session on Tuesday, but it is not much to worry about at this point. When you look at the candlestick from the Tuesday session, it is obviously much smaller than the one from the previous session on Monday, and even more so the Friday candlestick.

On Friday, we had bounced from the 50-day EMA and the uptrend line that I have drawn on the chart. This was a perfect bounce, suggesting that the uptrend was very much still intact. Nonetheless, we did pullback during the trading session on Tuesday, and it looks as if we failed to make a fresh, new high. That does not necessarily mean anything other than the “market memory” at the 15,800 level continues to offer a little bit of selling pressure. If we can break above there, then it opens up the possibility of a move towards the 16,000 level rather quickly.

The 16,000 level will offer a little bit of resistance due to the fact that it is a large, round, psychologically significant figure, but at the end of the day I do not think 16,000 is going to be particularly interesting. In the short term, I believe that we will probably continue to have plenty of buyers underneath, extending all the way down to the uptrend line and the 50-day EMA that has been walking right along that uptrend line for quite some time. With that in mind, I think that most traders will look at the DAX pulling back as offering a bit of value, especially if they still believe in the overall global reopening trade, as there is a significant long list of major manufacturers on the DAX that export larger industrials to the rest of the world.

One thing to be a bit concerned about is the fact that German factory orders dropped 9% last month, so if that keeps up it certainly will put a bit of a lid on the DAX. That being said, it all comes down to whether or not the rest the world is going to reopen and continue buying large machinery and the like. As it appears right now, for the most part, it still looks like the DAX trading community believes that will be the case. I have no interest in shorting this market until we get below 15,000.