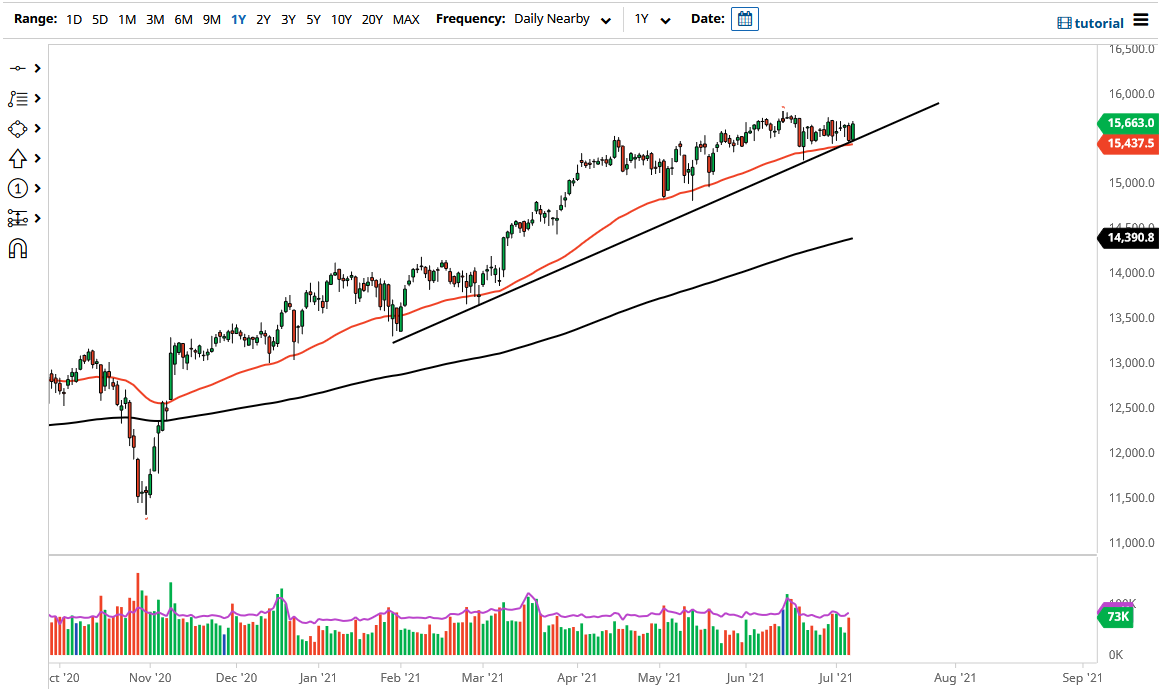

The DAX rallied a bit during the trading session on Wednesday to bounce from the large uptrend line that I have drawn on the chart. Furthermore, the 50-day EMA is sitting right there as well, so it does make sense that we would see market participants very interested in the DAX in this general vicinity. You could even perhaps make a little bit of an argument for an ascending triangle, but regardless, this is a market that clearly showed a proclivity to continue the uptrend during the day.

It is worth noting that the CAC 40 is a little less enthusiastic looking, so it will be interesting to see which one leads the way. At this point, the DAX looks as if it is going to outperform the CAC, which in and of itself is not a huge surprise, but it does suggest that perhaps money in the European Union is starting to go into safer assets, such as large German multinationals. Remember, the DAX is essentially a representation of a massive exporting economy and those massive industrial corporations coming out of Germany.

To the upside, you can make an argument for a bit of resistance at 15,700, which you could also argue is the top of a potential ascending triangle. If we can break above there, then it measures for a move to roughly 16,250 above. The 16,000 level itself will cause a little bit of resistance due to the fact that it is a large, round, psychologically significant figure, but I do not necessarily see anything in this level that will attract any more attention than any other big figure.

On the other hand, if we break down below the €15,250 level, then we could continue to go quite a bit lower. I suspect that if we do get a breakdown here, the real money will be made shorting the CAC, IBEX, MIB, and other smaller indices throughout the continent. Having said that, the first index in the European Union that will turn around and recover is almost always going to be the DAX, so in a sense I look at this very much like the US indices, as it is very difficult to short in general but does make a potential signal for other markets.