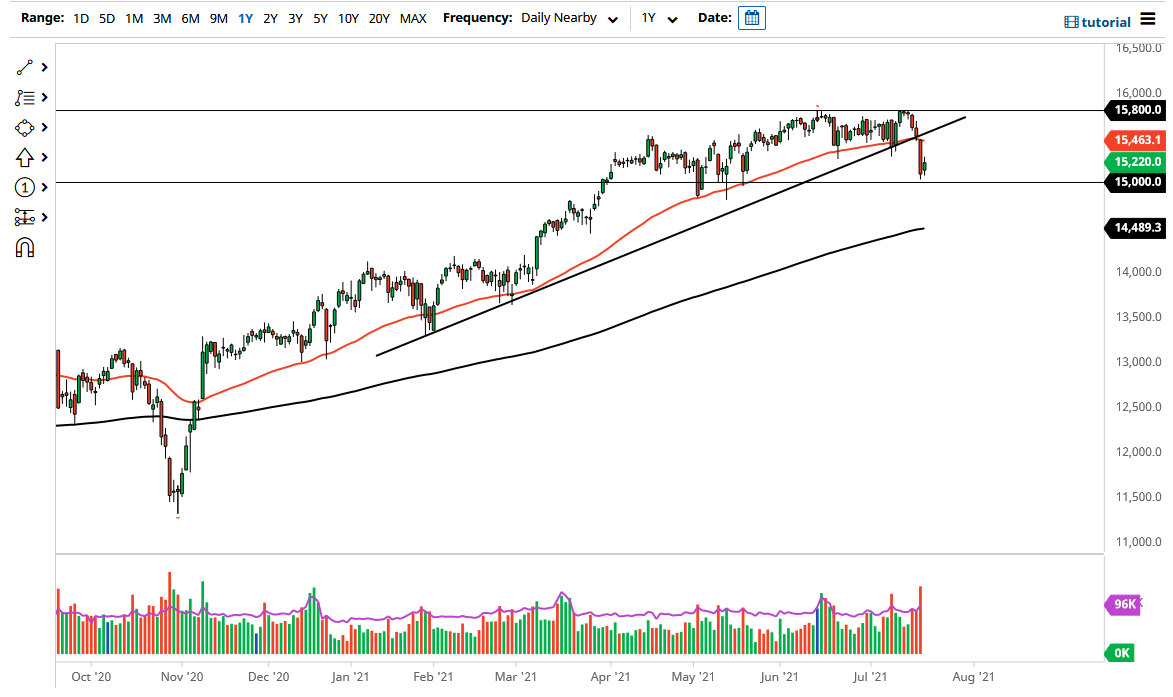

The DAX Index rallied a bit during the course of the trading session on Tuesday as we continue to see the market try to pick up a little bit of stability. After all, if stock markets around the world got absolutely hammered, the German index will follow right along as we have seen early in the week. The recovery was a good sign, but we still have not wiped out a lot of the losses, and we are well below the uptrend line that previously had been so important. It is because of this that I am a bit hesitant to get long of this market, but I also recognize that this was an initial important first step.

The 15,000 level underneath is support, and as long as we can stay above there, that gives the DAX a bit of hope and keeps the possibility of a longer-term uptrend very much intact. If we break above the top of the candlestick during the trading session on Tuesday, then it is very possible that we will go looking towards the 50-day EMA above, which also happens to be the top of the Monday candlestick. This is just underneath the 15,500 level, so that obviously is an area that a lot of people will be paying close attention to.

At this point, I would anticipate that the previous uptrend line comes into the picture and offers resistance. The market may try to retest that area and perhaps fail. However, if it does not fail, then it is likely that we will go looking towards the highs again. The 15,800 level above is the high, so I think if we can break above there then the market is free to go looking towards the 16,000 level, possibly even higher than that.

If we were to break down below the 15,000 level, then it is very likely that the DAX will go looking towards the 200-day EMA, which currently sits at the 14,500 area. Breaking below that would open up massive selling in a huge bear market. In the short term, I fully anticipate that we will try to recover, but whether or not we can hang on to the gains would be a completely different question, as traders around the world continue to pay close attention to the idea of increasing Delta variant numbers.