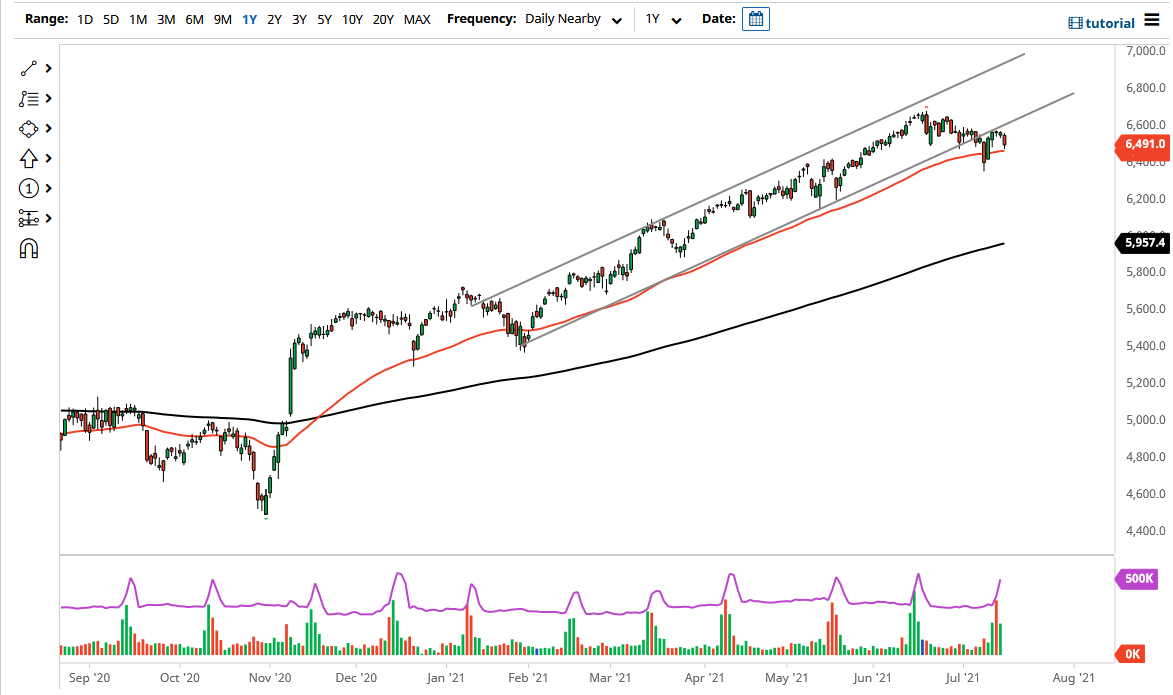

The Parisian index has fallen a bit during the course of the trading session on Thursday as we continue to see quite a bit of risk out there when it comes to the global growth situation as the interest rates in various bonds around the world continue to fall, that is a sign that perhaps people are starting to get concerned about global growth in general. At this point in time, the market is looking at the 50 day EMA as support in the short term, and it is worth noting that we had previously bounce from there. At this point in time, it certainly looks as if we are going to struggle to continue going higher, and as long as there is a general “risk off” attitude around the world, it makes sense that the Parisian index may suffer as a result. In fact, we have seen this all across the world during the session.

If we break down below the most recent low at roughly 6350, the market could very well go down to the 200 day EMA underneath. The 200 day EMA is sitting just below the 6000 level, so that could possibly be a target for traders in the short side. I suspect that if the CAC takes off to the downside, it is likely that the market around the world will all move in the same direction. At this point in time, Paris seems to be under threat from the recent writing when it comes to the “Covid passport” as well, so really at this point in time it is likely that the CAC will underperform other European indices anyway.

A self-imposed slowing down of the economy could be a major problem for France, but we do need to pay close attention to whether or not that actually goes through or whether or not people are willing to do it. I think at this point in time it is very likely that the market is going to be erratic to say the least, but if we did take off above the 6600 level, it could be a bullish sign. Another thing to pay attention to though is the fact that we have recently broken out of a bullish channel to the downside, and then bounced back to retest that area for resistance. So far, it certainly looks as if the CAC only needs a little bit of a “push.”