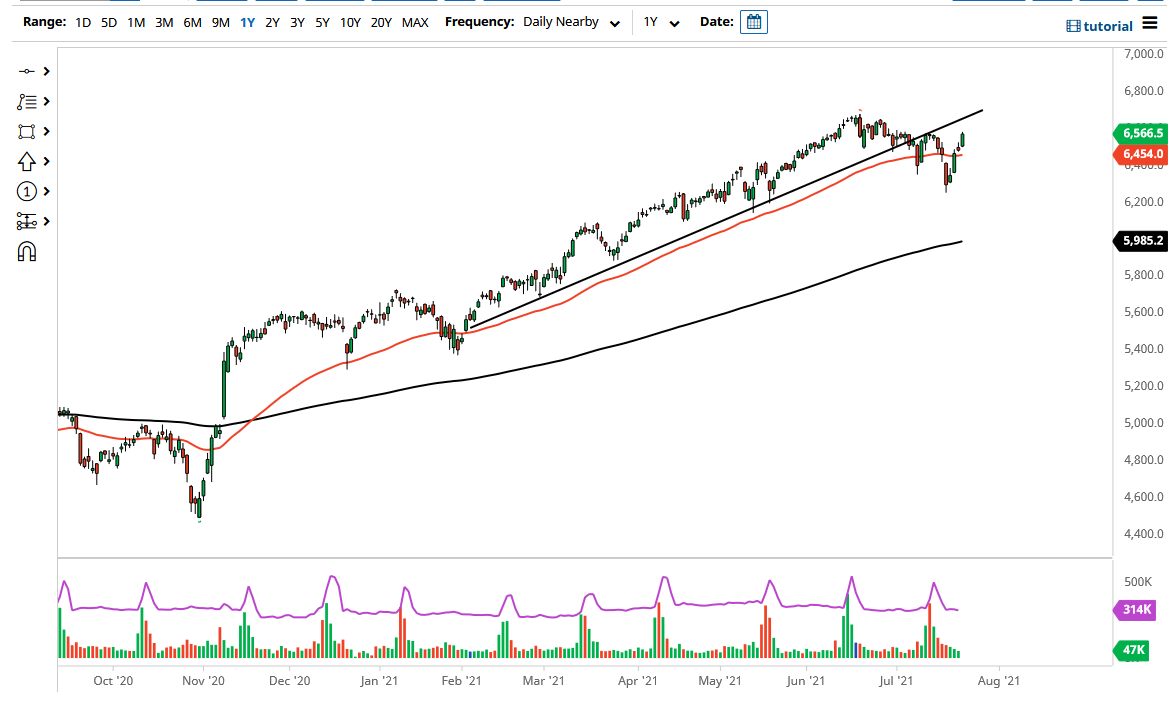

The CAC Index recovered quite drastically during the last several sessions, with Friday closing at the absolute highs. That is a very strong sign, and it now looks as if we are ready to continue going higher. While it did look very negative at one point, risk appetite around the world turned around quite dramatically this week, and on a high note overall. The CAC is going to be no different than any other index, and perhaps even could move a little quicker than some of the other ones, such as the DAX.

Just above, I believe that the 6600 level could offer a little bit of resistance, but it looks like short-term pullbacks will continue to be bought. This will be especially true as long as we can stay above the 6250 handle, which is where we had bounced from previously. If we were to turn around and break down below that level, it would confirm a downtrend in the sense that we would have a “lower low.” That is a very bearish sign and could lead to significant losses, perhaps driving the market down towards the 200-day EMA which currently sits just below the 6000 level. The 6000 level has a lot of psychology attached to it, so I do believe that a lot of traders would be looking at that level quite closely.

Overall, you can make an argument for either a little bit of volatility causing the pullback, or just simply a little bit of exhaustion. While it did look very ugly on Monday for a lot of markets, just as many others recovered, the CAC followed right along. Keep in mind that the Parisian index features more along the lines of luxury brands, so it is more of a “risk on environment.” This is especially impressive considering that France has been having issues with lockdowns in certain parts of the economy and the so-called “vaccine passports” causing social concerns. As things stand right now, it remains a “buy on the dips” scenario, with perhaps an eye on trying to break out to the highs again. If the DAX breaks out, the CAC will more than likely follow right along with it as it does typically follow given enough time. Remember, the CAC always play second fiddle to the DAX.