Last Wednesday’s Bitcoin signals could have produced a losing short trade from the bearish reversal at $32,817.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be taken prior to 5pm Tokyo time Tuesday.

Long Trade Idea

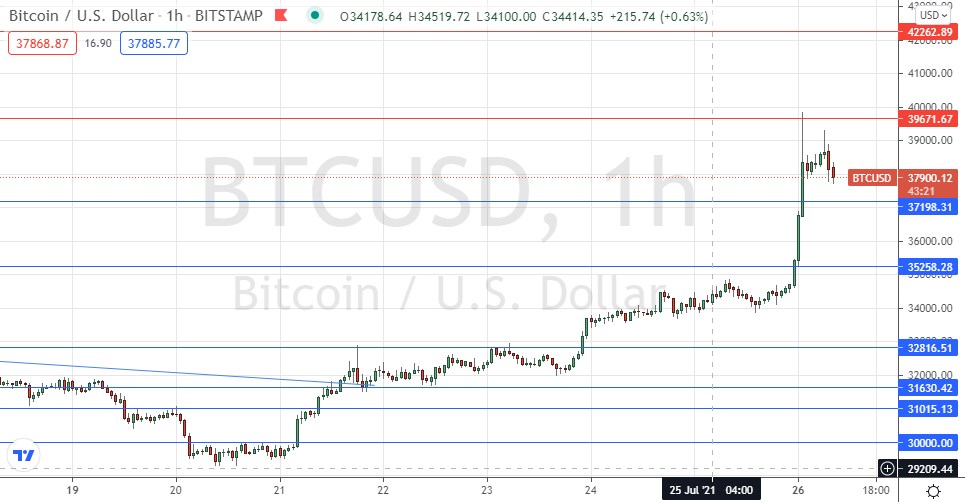

Go long after a bullish price action reversal on the H1 time frame following the next touch of $37,198, $35,258, or $32,817.

Put the stop loss $100 below the local swing low.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Idea

Go short after a bearish price action reversal on the H1 time frame following the next touch of $39,672 or $42,263.

Put the stop loss $100 above the local swing high.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Wednesday that the technical picture remained very bearish, and the threat of a massive breakdown once the price got established below that pivotal support level at $28,607 was very real.

This was a good call as anyone wanting to go short who waited until the price got below $28,607 would have avoided a big loss. The price was not able to even reach that level before turning around and breaking out of the medium to long-term bearish price channel which had dominated the technical picture.

The price has risen solidly over past days, and in just the past few hours (late in Monday’s Asian session) rose by approximately 10% in value to hit a 1-month high price just below $40k.

There are two likely reasons for this strong rise: firstly, the technical picture turning bullish which always encourages strong buying in Bitcoin due to all the cult-like hype around the cryptocurrency; secondly, Elon Musk said Tesla will likely soon resume accepting Bitcoin and Amazon also indicated something similar.

Unfortunately for bulls, it looks as though the upwards thrust may be done for the time being, although there remains a good case for buying at any support levels which may be reached today during the current bearish retracement, if there is a bullish bounce at any of them.

If the price gets established above $40k today, that would be a very bullish sign that would signal a good likely buy on a dip then back to $40k.

Bitcoin is back for bulls.

There is nothing of high importance scheduled today regarding the USD.