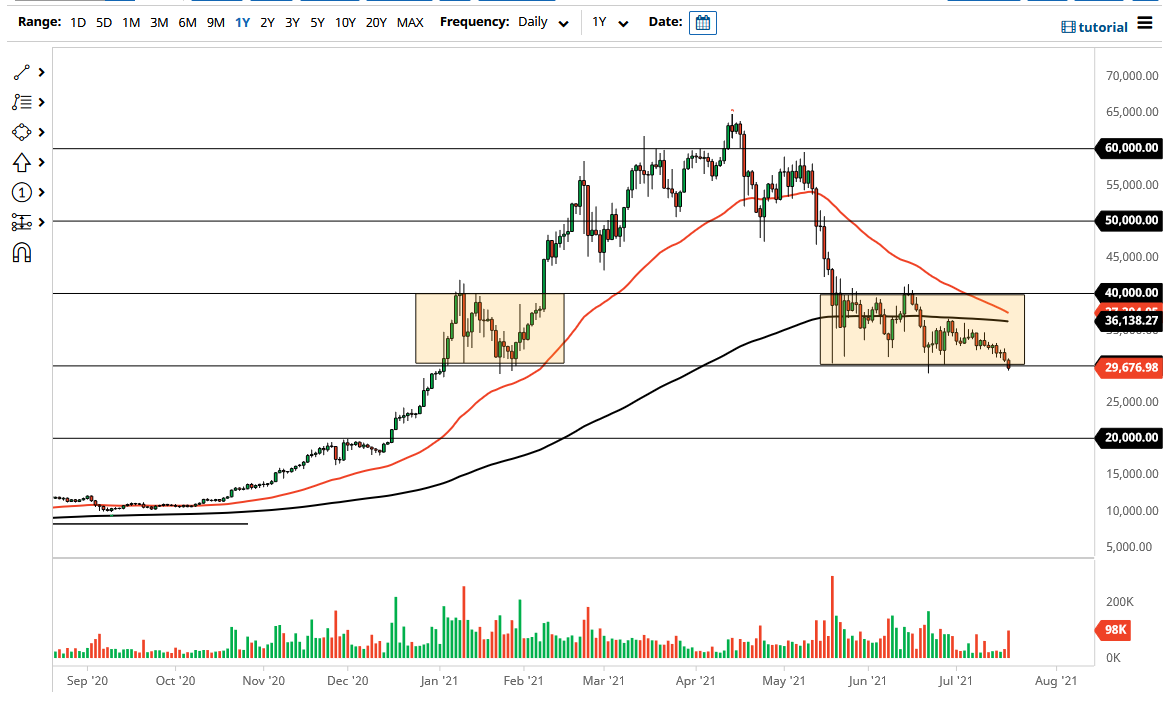

The Bitcoin market fell again during the trading session on Tuesday to pierce the $30,000 level, the bottom of the most recent consolidation area, which has the $40,000 level as a massive resistance barrier. If we can break above that level, that would change a lot of things; but there is nothing on this chart that suggests that we are about to do so.

China has recently banned financial entities from facilitating crypto trading, which was a major hit against the sector. Furthermore, mining has been broken apart as well by the Chinese authorities, so that has brought down the hash rate. In yet another blast against the crypto world, the US dollar has strengthened quite a bit, which is worth paying attention to as it is the other half of this currency pair. Furthermore, from a technical analysis standpoint, we are getting ready to see a “death cross” as the 50-day EMA is starting to reach towards the 200-day EMA. That is a longer-term “sell and hold” signal for short sellers.

Rallies at this point in time will be sold into, and I believe that the 200-day EMA will continue to be a massive “ceiling” in the markets. On the other hand, if we were to break down below the bottom of the candlestick for the trading session, then it is very likely that we will go looking towards the $27,000 level, followed by the $25,000 level and then eventually the $20,000 level. The $20,000 level is the “measured move” of the recent consolidation area, so I think at this point we will try to get there. If we break down below there, then it is another major milestone that we will see in the rearview mirror, and it is likely that we could drop rather drastically if that does happen.

It comes down to whether or not you are a longer-term or shorter-term trader. As far short term is concerned, you can only be a seller at this point. If you are a longer-term trader, then you can start looking to the idea of some type of significant breakdown in order to accumulate little bits and pieces to build up a larger Bitcoin position. I believe that we will continue to see a “crypto winter” occasionally, as adoption is still quite some time away.