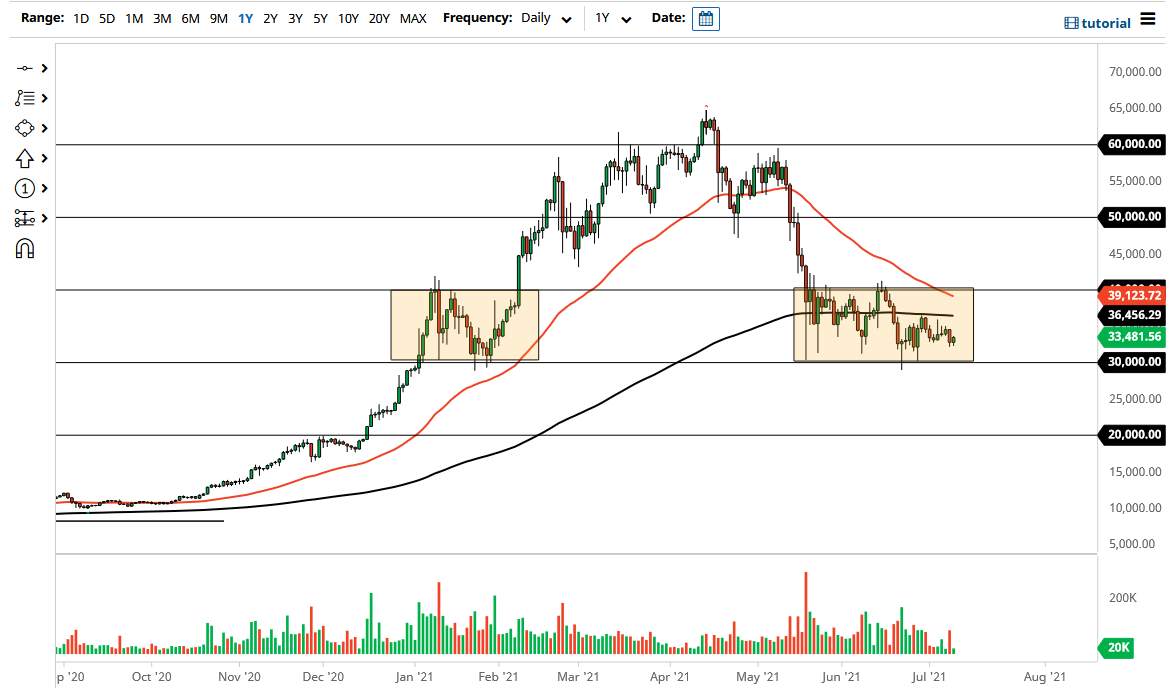

The Bitcoin market did rally just a bit during the trading session on Friday, but this is a marketplace that is continuing to struggle overall, as we had initially bounced over the last couple of weeks but cannot seem to be able to get above the 200-day EMA. The 200-day EMA has been going sideways for a while, and you will notice that previously we had been able to break back above it. With this being the case, I think that we are certainly getting relatively close to some type of breakdown.

When you think about that breakdown, the $30,000 level underneath continues to offer support while the $40,000 level above continues to offer resistance. In other words, we are in a $10,000 consolidation area, and that is most certainly worth paying close attention to. This is because there will be a bit of a “measured move” on the breakout or the breakdown. Simply put, if we break above the top of the range at the $40,000 level, then the market could very well go looking towards the $50,000 level. On the other hand, if we were to break down below the $30,000 level, then it is likely that we will go looking towards the $20,000 level underneath.

The $20,000 level is very important, due to the fact that it is a large, round, psychologically significant figure, but perhaps more importantly than that, it is where the bubble had popped during the initial run-up in Bitcoin years ago. If we get that up, then it is likely that Bitcoin would go much lower. That is what I hope will happen, because I would love to be able to buy Bitcoin at extremely low levels, but whether or not we get that opportunity remains to be seen.

If we break above the $40,000 level, then it is likely that we could go looking towards the $50,000 level. That obviously would be an area that would catch quite a few headlines. It was also previous support, so it should be resistance based upon “market memory” as well. Looking at this chart, I have to say that it certainly looks like we are threatening the downside due to the fact that we could not recapture the top of the range as of late, but it is not until we get that close below $30,000 level that we can actually start selling.