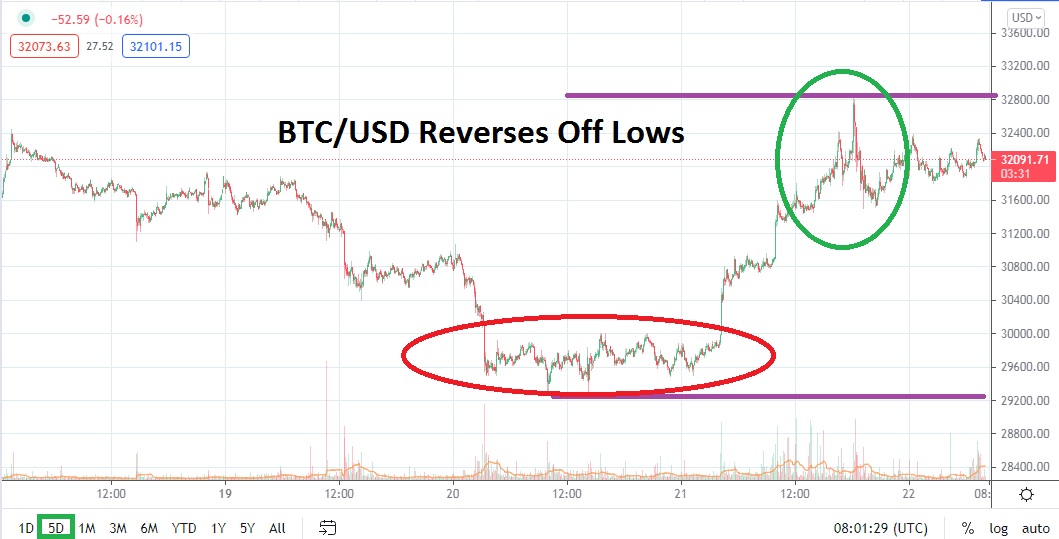

Bitcoin is trading near 32250.00 as of this writing, and given the dynamic ability of BTC/USD to move, if the price is one thousand dollars away from this mark upon reading this article please forgive me. Only two days ago, BTC/USD was trading below the 30000.00 price juncture and it tested a low of nearly 29250.00. Traders who are determined to wager on Bitcoin need to understand the endeavor carries a substantial amount of risk.

While BTC/USD has certainly gained the past two days, it remains under important resistance near the 33000.00 juncture. The last time Bitcoin traded above this value was on the 13th and 14th of July. The lows tested on the 20th of July essentially came within sight of prices last seen on the 22nd of June. The mid-term trend of BTC/USD remains progressively bearish. A technically sustained bullish move higher consisting of more than a few days has proven rather elusive for speculators to find.

Today’s slight move higher which tested the 32350.00 mark only a handful of hours before is intriguing, and bullish speculators who want to aim for higher resistance cannot be blamed. However, BTC/USD has produced a solid trajectory of slight reversals higher which run into rather durable resistance, only to be pushed backwards and then challenge important lows. The inability of BTC/USD to puncture the 29200.00 mark below a couple of days ago can be interpreted as a positive by bullish traders, but it may also prove a dangerous warning sign that additional lows will develop.

If BTC/USD runs into headwinds today and is not able to seriously challenge the 32400.00 to 32500.00 junctures, it may trigger another dose of negative sentiment. Speculators need to pay attention to technical charts certainly, but they should also monitor whispers on social media as influencers try to ‘talk up’ Bitcoin. The problem the past month for BTC/USD has been that nervous sentiment has created erosion in trading volumes. The question is when and if BTC/USD backers will feel comfortable enough to become buyers in mass once again. Speculators who have been hoping for a positive momentum shift of BTC/USD have likely been frustrated.

Traders who seek short-term gains may want to buy BTC/USD on slight reversals lower towards the 32000.00 juncture. Speculators are advised not to become overly ambitious and use take profit and stop losses wisely. If a trader thinks more downside price action is going to emerge, they may want to be cautious and be sellers only when BTC/USD has touched resistance near the 32300.00 to 32400.00 junctures.

Bitcoin Short-Term Outlook:

Current Resistance: 32400.00

Current Support: 32100.00

High Target: 32900.00

Low Target: 31300.00