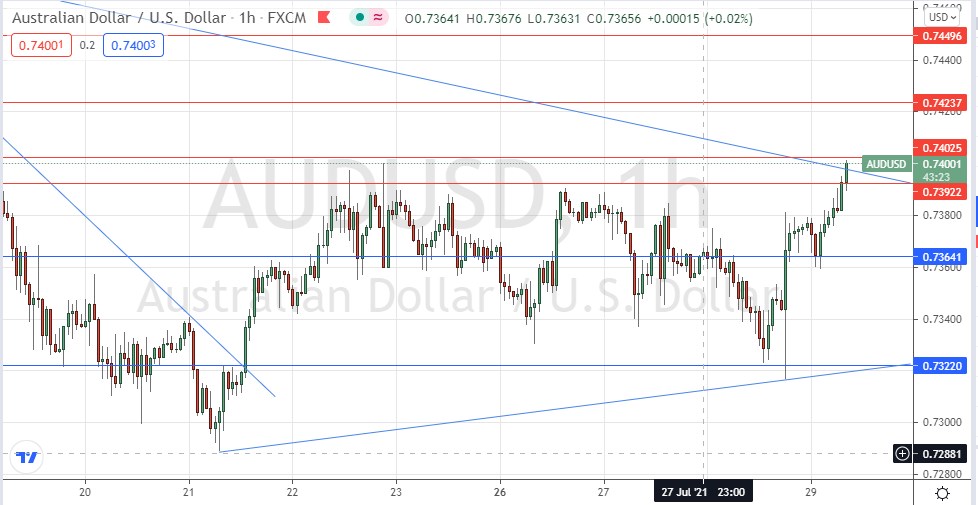

Last Tuesday’s AUD/USD signals were not triggered, as there was insufficiently bullish price action when the support level identified at 0.7341 was first reached.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken before 5pm Tokyo time Thursday.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7403, 0.7424, or 0.7450.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7364 or 0.7322.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Tuesday that as the Australian dollar was one of the weakest major currencies at present and we also had a bearish technical picture.

I was looking to take a bearish bias if we had gotten two consecutive hourly closes below 0.7322, or a bearish reversal at 0.7392 following a retracement to that resistance level, as the breakdown needed to cross a technical barrier – the low at 0.7322.

This was a good call as the price never reached 0.7322 and, in fact, this was the pivotal support which began the major upwards thrust following the FOMC release yesterday, so I was correct about the importance of this level. My analysis was at least enough to keep any potential short traders out of trouble.

The technical picture has changed significantly since Tuesday as we have seen a reversal against the US dollar since the FOMC release yesterday. However, the Australian dollar is relatively weak so it has not seen such a strong advance against the greenback, but it is advancing, nevertheless.

Technically, we are seeing the price strongly challenge the round number at 0.7400. If the price can get established above 0.7403 over the coming hours, that will be a minor bullish sign.

I think this currency pair remains more interesting to trade short than long, but traders should wait until the US dollar starts getting bought again. Traders wishing to trade with the short-term trend against the US dollar will probably do better using currency pairs today such as the GBP/USD or EUR/USD.

Regarding the USD, there will be a release of Advance GDP data at 1:30pm London time.

There is nothing of high importance oncerning the AUD scheduled for today.