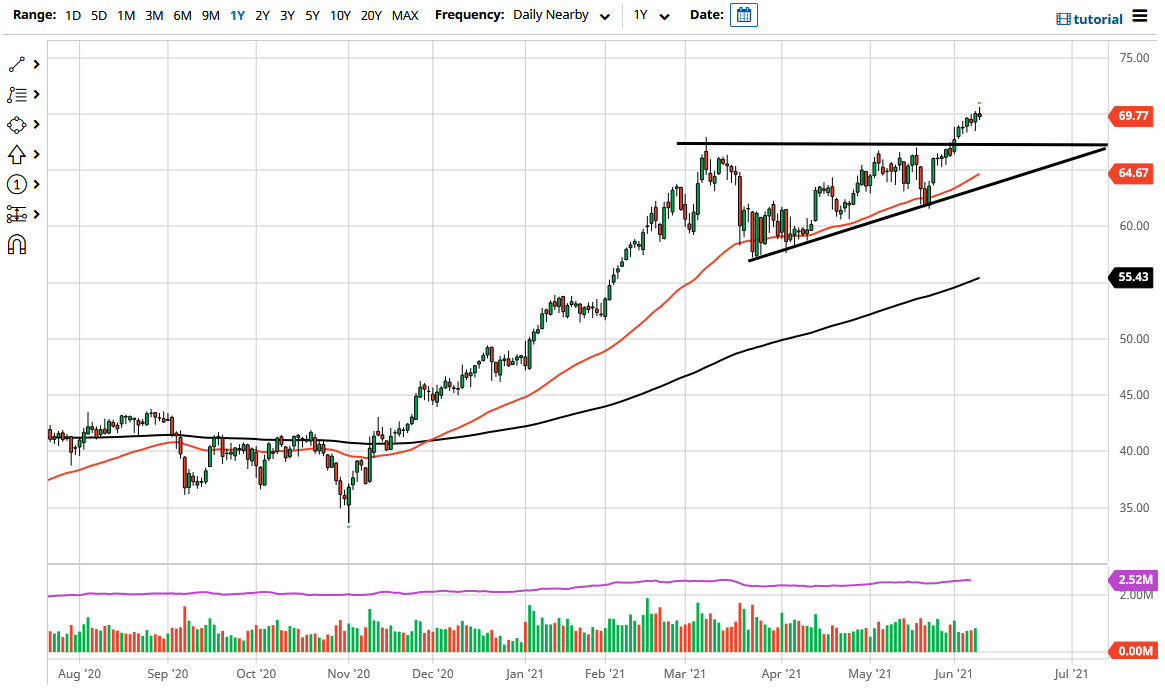

The West Texas Intermediate Crude Oil market rallied initially to kick off the trading session on Wednesday, but after a less than thrilling inventory number, the market pullback brought oil to below $70 a barrel again. Breaking through that level initially was a good sign, but at this point it looks like we are simply going to jump around and try to build up enough momentum to finally break through the $70 level and go higher over the longer term.

All of that being said, I still believe that the market is ready to go higher, at least from the longer-term standpoint. After all, we had broken above the ascending triangle, and have been in an uptrend for a while. With that being the case, I think that the $67.50 level will continue to offer support as it was resistance from that pattern. The measured move of the pattern suggests that we could go as high as $77.50, and I certainly think that this is a market that regardless of the volatility, you should be looking at as one that should be bought.

When you look at this chart, it should also be obvious that the 50 day EMA has been dynamic support, and I do think it will continue to be so going forward. It is because of this that I think if we were going to break down below the 50 day EMA, then I might think about shorting but until then it is obviously in an uptrend, and I do think that the demand is going to continue to pick up as global economies continue to reopen. In fact, OPEC has recently announced that they believe demand will pick up by 6 million barrels per day between now and the end of the year, which of course is huge.

I think that it is probably going to be a very choppy and noisy market, but it should continue to go from the lower left to the upper right, just as it has over the last several months. If we get some type of major pull back during the CPI figures on Thursday, I will look at that as a nice buying opportunity and essentially a gift from algorithms that react first, and think later. Nonetheless, I remain bullish regardless of what happens over the next 24 hours.