The West Texas Intermediate Crude Oil market has gone back and forth during the trading session on Thursday as we may have run out of steam heading towards the jobs figure on Friday. The latest figures continue to show a very uneven recovery when it comes to demand for distillates and other products, but nonetheless people are still banking on the demand that OPEC claims is going to be here for the rest of the year. Whether or not that is true is a completely different question, but it is obvious that reopening economies will demand more energy.

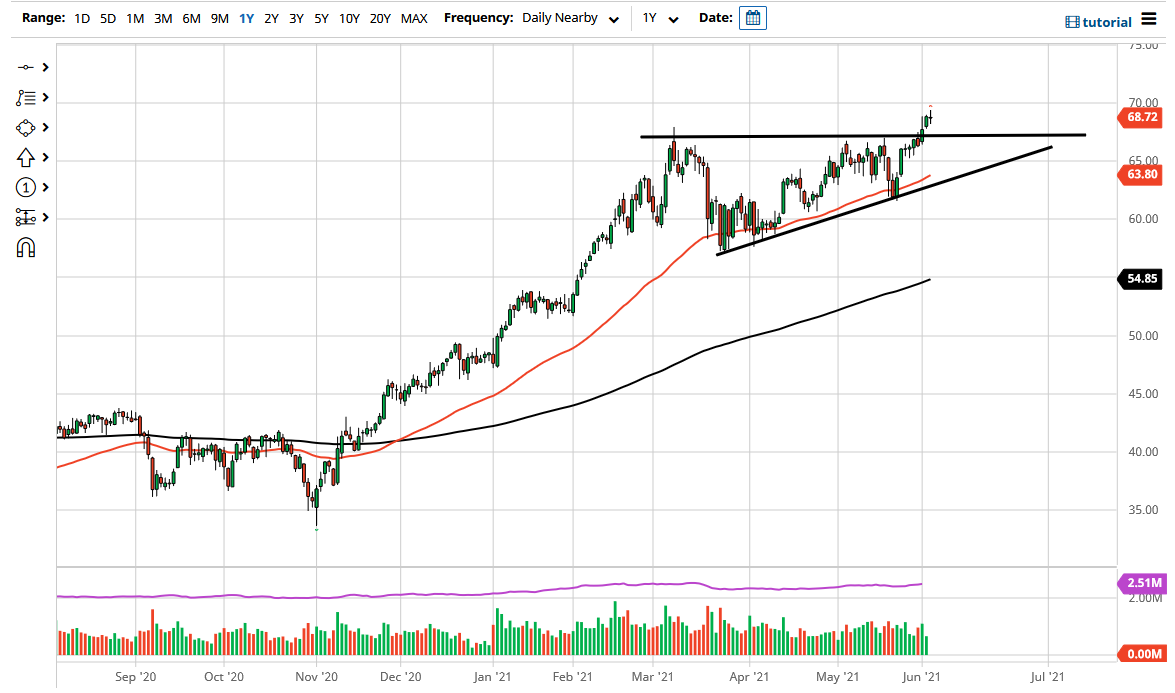

Looking at this chart, I believe that it is obvious support just waiting to happen at the $67.50 level, which was the previous resistance barrier for the triangle. Because of this, I think that “market memory” would probably come into play sooner rather than later, and therefore I like the idea of getting long on any hint of “value.” I think it is only a matter of time before people would be looking towards this market for some type of trade to go long. In fact, it is almost impossible to imagine a scenario where I would be a seller of crude oil, but there are couple of potential technical indicators that could set this up.

If we were to break down below the 50 day EMA and perhaps the uptrend line of the ascending triangle that kicked all of this latest move off, then I could imagine a scenario where I would be a seller. The $60 level would be support but breaking down below there then opens up the possibility of a move towards the $55 level where the 200 day EMA comes into the picture. All things being equal, the demand for crude oil probably picks up through the summer regardless, because it is a rather bullish time of year anyways due to the “summer driving season” in the United States. With this, I have no interest whatsoever in trying to short this market until we get some type of major breakdown, and that would probably take some type of huge shift in attitude or some type of major “risk off event” that I just do not see happening right now. Yes, Friday is of course the jobs number, and it could cause a lot of volatility, but it will not change the overall trend.