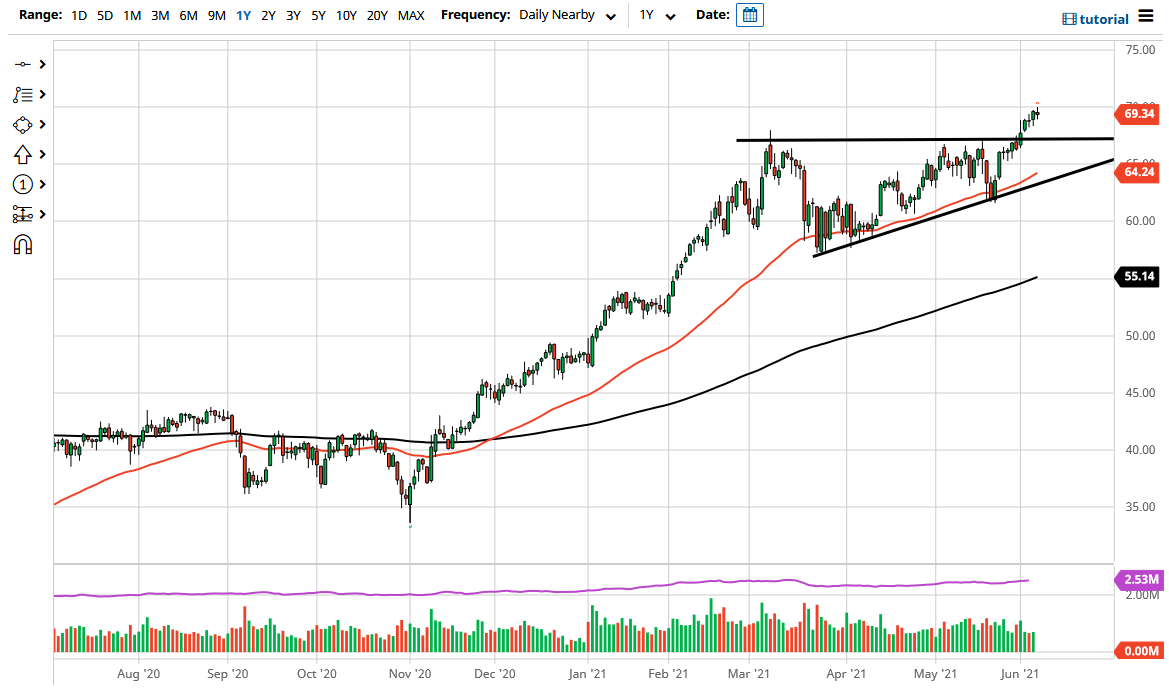

The WTI Crude Oil market fluctuated during the trading session on Monday as traders came back to work. That being said, we did find a significant amount of exhaustion at the $70 level to turn things right back around and form a somewhat exhaustive candle. Even if we do pull back from here, I believe there is plenty of support underneath that will come into play, not the least of which will be where the $67.50 level comes into the picture.

We had recently broken above the top of the ascending triangle, which signifies that there is a certain amount of structural support underneath. In fact, when you look at the height of the triangle, it suggests that we are going to go looking towards the $75 level, but obviously we need to break through the $70 level to get that type of momentum.

When you look at the overall fundamental forecast, it is worth noting that OPEC has recently stated that they expect to see more demand for the rest of the year, as the world’s largest economies reopen. The reopening shock has pushed the demand part of the supply/demand curve straight through the upside. I think that we are looking at a market that has further upside to it, but we may need to get a bit of a pullback in order to offer value. In fact, it is not a market that I am willing to simply jump into right now unless we get a daily close above the $70 level, signifying that we have smashed through the resistance from the previous session.

Keep in mind that the US dollar has its own influence on this market, as a falling US dollar does tend to offer support for commodity prices, especially crude oil. After all, it is going to take more US dollars to buy a barrel of crude oil if the value of the currency crumbles. Adding to that is the fact that OPEC expects more demand going forward, so it does make sense that we continue to reach to the upside. Underneath current trading, we not only have the top of the triangle, but we also have the 50-day EMA walking right along the uptrend line of the triangle.