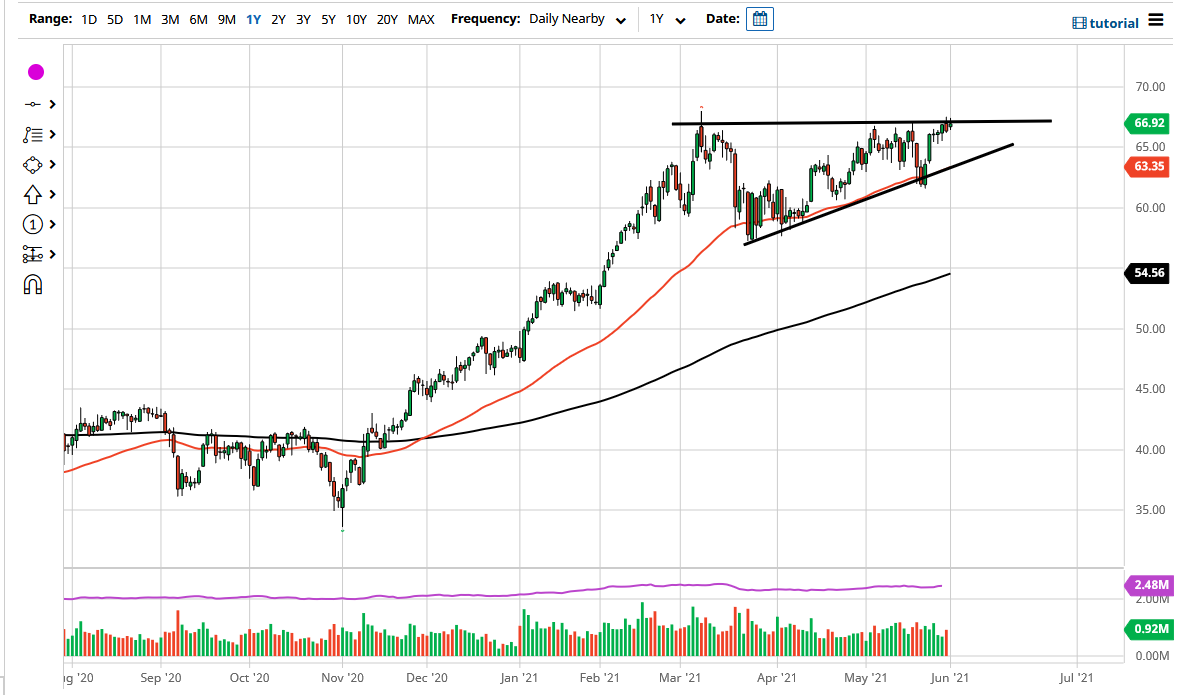

The West Texas Intermediate Crude Oil market has been a little bit choppy during the trading session on Monday, as we had a serious lack of liquidity due to the Memorial Day holiday, and very thin electronic trading. Because of this, the market is likely to ignore the trading session in and of itself, but what is worth noting is the fact that we had already been trying to rally and breakout of this triangle for a while, so I think it is only a matter of time before we finally get the push higher.

OPEC+ is meeting during the trading session on Tuesday, so you can expect a lot of noise coming out of the headlines. Nonetheless, unless they do something particularly unexpected, I anticipate that the market will continue to look at the reopening trade and the possibility of increased demand. Recently, both OPEC and British Petroleum confirmed the idea of demand for crude oil picking up 6 million barrels a day for the rest the year, so that is one thing worth paying attention to, whether or not they downgrade their forecast. I do not anticipate that being the case, so more likely than not we will continue to see upward pressure.

If we can break above the $67.50 level, then it is likely that we will break out and go towards the $70 level above which is the short-term target. $70 is a large, round, psychologically significant figure, and something that a lot of people would have to be paying attention to. If we break above there, then it opens up a move to the $72.50 level next.

To the downside, if we break down below the 50-day EMA and the uptrend line, then it is possible that we could go looking towards the $60 level where I would anticipate seeing a lot of support. Breaking down below that level would be very bearish, but I would think somewhat impossible without the US dollar spiking suddenly and OPEC changing its tune in general. That being said, dips should continue to offer buying opportunities for those who are patient enough to wait for them. A falling US dollar could be helpful, but we will have to wait to see whether or not it happens.