The West Texas Intermediate Crude Oil market rallied again during the trading session on Wednesday but pulled back a bit from the $72.50 level. This is an area that I have been paying close attention to based upon the breakout of $70, and now that we are starting to show reaction to that area it looks like we could see a little bit of a pullback. That pullback should be good news though, because it should give you the opportunity to pick up oil on a dip.

Despite the fact that it is a shooting star, it is not the end of anything major here, and it should be noted that the Federal Reserve had a meeting and statement during the trading session, which would add more noise to the market than usual. Ultimately, I think that the $70 level underneath should be relatively supportive, if for no other reason than psychology. Because of this, I would like to see a pullback to that area that found buyers, so that I think we could work off some of the short-term froth.

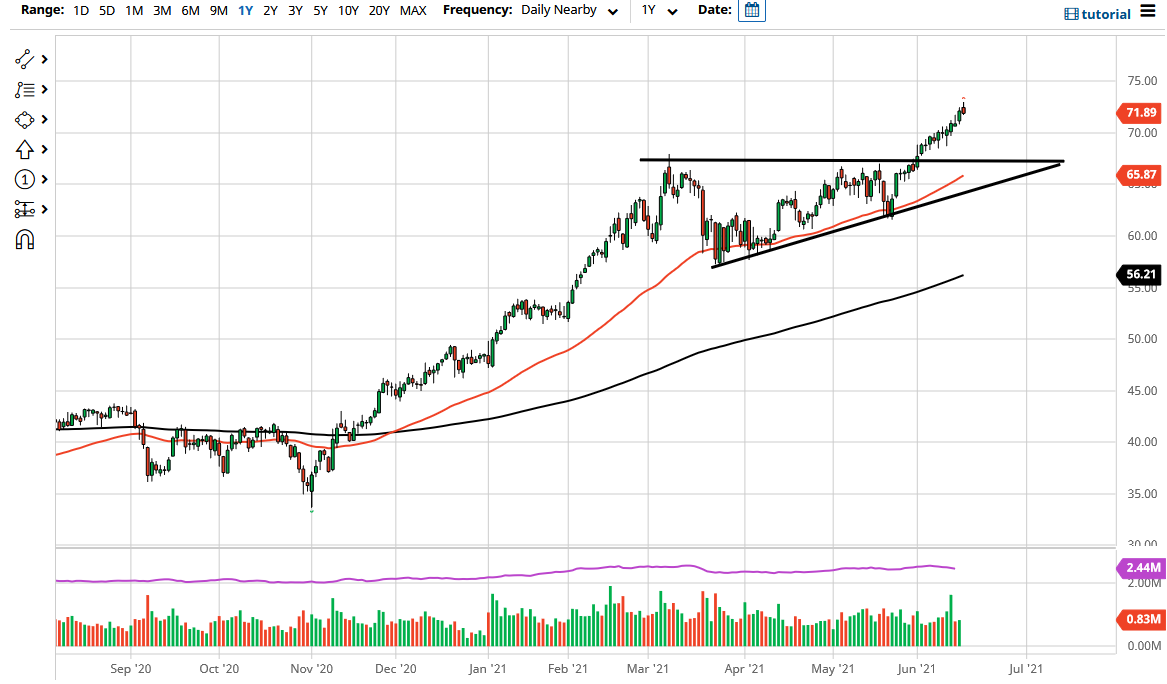

Regardless, when you look at the chart you can see that we broke out of an ascending triangle, which is a very good sign. By doing so, it looks as if the market will be trying to take advantage of longer-term momentum, especially as the 50-day EMA is starting to reach towards the top of that triangle. With that being said, I think that the markets are probably going to continue to see support at the top of the triangle and the $67.50 level. We are in an uptrend, and a lot of people out there are focusing on the idea of taking advantage of value by ”buying the dips.” I think that will continue to be the trade until we get to the $77.50 level, which is my longer-term target. I think we could even overshoot that area and go looking towards the $80 level given enough time. That does not mean that we will get there overnight, and most certainly there will be the occasional zig and zag. That is normal behavior, especially after we have seen such a massive move to the upside. With that in mind, I am simply waiting for signs of support after a pullback that I can take advantage of.