The West Texas Intermediate Crude Oil market continued to rally again during the trading session on Monday amid major “risk off” behavior after the Federal Reserve suggested that perhaps tightening was going to be quicker. However, the market has seen a complete turnaround and perhaps a little bit of “walking back the narrative” by the Federal Reserve, as the US dollar has calmed down. This has had people looking for more risk, and that means, by extension, commodities.

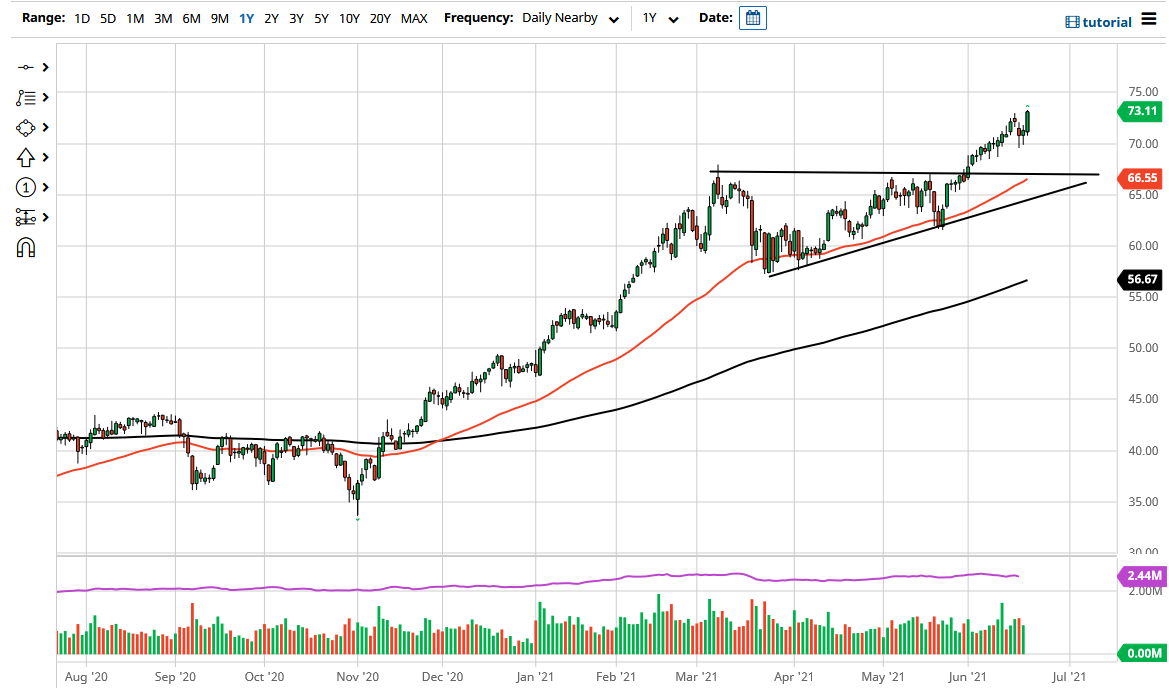

The crude oil market has broken above the $73 level to make a fresh, new high. I believe that this market will continue to extend towards the $75 level, which is the next large, round, psychologically significant figure. Furthermore, I think that we will even go above there to go reaching towards the $77.50 level, based upon the “measured move” of the ascending triangle that we have recently broken out of. Speaking of that triangle, we also have the 50-day EMA reaching towards the $67.50 level, which was the top of the triangle. It is because of this that I think the market will probably look at that area as a “hard floor in the market” going forward.

I think this continues to be a bit of a “buy on the dips” type of situation, which it has been for quite some time. Ultimately, this is a market that cannot be sold, at least not until we break down below the bottom of that triangle, which would be extensively below the $65 level. That is eight dollars underneath, which would be a rather significant change of tone. With that being the case, I think it is only a matter of time before you get an opportunity to pick up value that you can take advantage of. With that in mind, the market is likely to continue the overall uptrend that we have seen for ages now.

If we were to break down below the ascending triangle, then it is possible that we go looking towards the $60 level underneath, perhaps even the 200-day EMA. The market is likely to look at the demand more than anything else to push this market higher. The reopening trade continues, and it is worth noting that the crude oil market is probably the quickest way to pay attention to inflation as well.