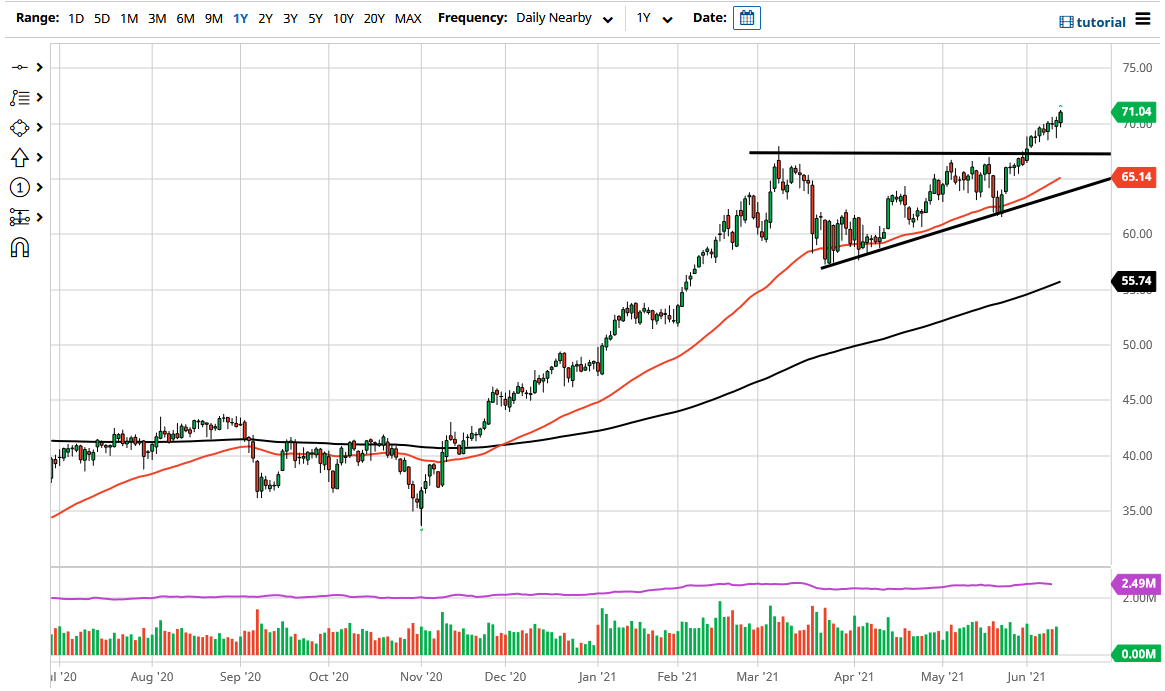

The West Texas Intermediate Crude Oil market rallied again during the day on Friday as traders were very comfortable hanging onto crude oil heading into the weekend, and even closed towards the top of the range. We broke above the $71 level, which now makes the $70 level offer a bit of support and could become an area that buyers are willing to defend.

When you look at the last couple of months, we have formed a nice ascending triangle, and now that we are above it, it suggests we are going to continue grinding towards the $77.50 level based upon the “measured move.” Furthermore, the 50-day EMA has offered quite a bit of support as of late, and I look at it almost like an uptrend line. The uptrend line extends further, so I think that we will see the trend line show support down the road, perhaps on the next major pullback. This is a market that I do not have any interest in trying to short, because it has been so strong for so long.

Crude oil demand should continue to pick up, and it is worth noting that the International Energy Administration has released its report during the day suggesting that crude oil demand will reach pre-pandemic levels by the end of next year, which coincides quite nicely with OPEC and its recent assessment that we would be seeing an additional 6 million barrels of crude oil demanded everyday, going from now until the end of the year. With the reopening economies, it does make sense, as there is a massive rush to make up for lost time as 2020 was essentially a “lost year.”

The question then becomes whether or not this can last for the long term? I do not necessarily think so, because “pent-up demand” can only last for so long. Eventually, we will get back to normalcy, and when we do, the question then is whether or not we will continue to see strength, or if we will see a flattening of demand. I suspect it will be the latter of the two, as growth issues that had been around previously will probably only be exacerbated by massive amounts of debts in the world economy. Nonetheless, for the next few months, this should be a very bullish market.