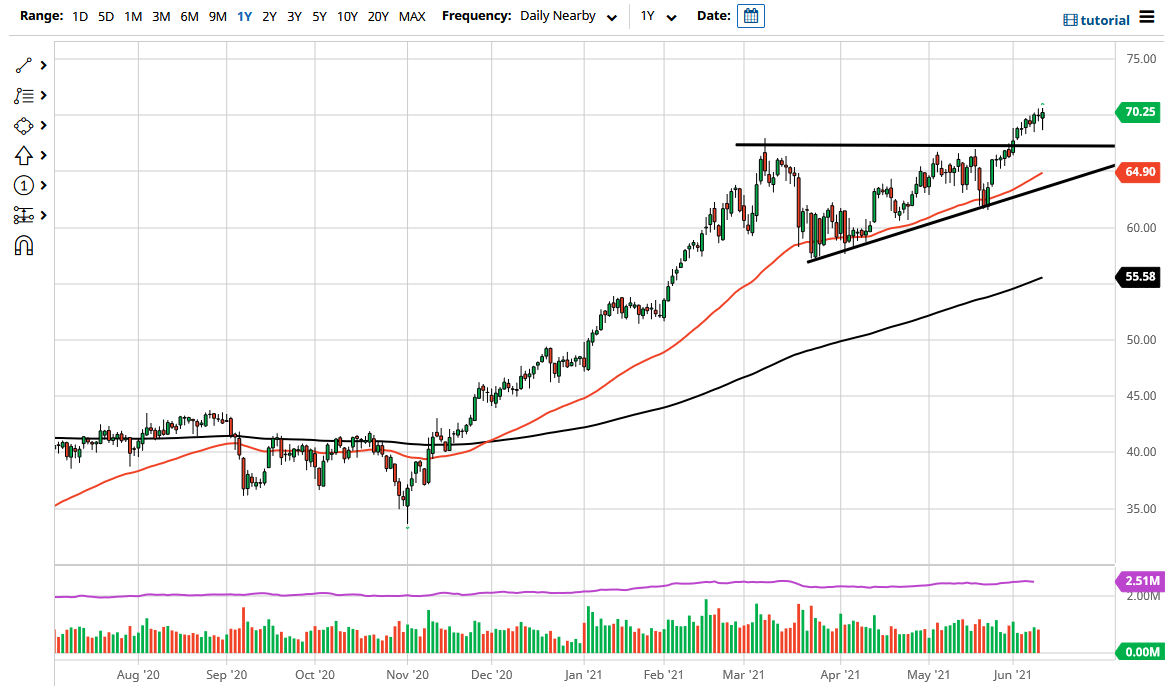

The West Texas Intermediate Crude Oil market initially fell during the trading session on Thursday as traders awaited CPI figures. Now that the market has digested the 5% gain year-over-year, it looks as if the market started to focus on demand to push this market above the $70 level. The $70 level is a large, round, psychologically significant figure, and of course the markets will pay close attention to it. At the moment, it looks as if it is a bit of a magnet for price, so you can almost use it like the midline on a Bollinger Bands indicator.

The $67.50 level has been significant resistance, and now should be significant support. After all, it is the top of the ascending triangle that we have formed recently. At this point, the market is signaling a “measured move” of $10, which opens up the possibility of a move all the way to the $77.50 level. I do not think it is going to be easy to get there, but it is my longer-term target by the end of the summer. Because of this, I like the idea of buying on the dips as it offers plenty of value that we can take advantage of in what has been a very strong uptrend.

The US dollar also has its part of play in this market, as oil is priced in that same currency. In other words, it takes less of that currency to buy a barrel of oil. Ultimately, this is a market that you should not be a seller of, and I would have no interest in doing so until we get down below the 50 day EMA, perhaps even the uptrend line that made up the ascending triangle. Because of this, we are a long way from trying to get below that area. Ultimately, this is a market that I think has a long way to go to the upside, but it is going to be more or less a grind to the target. I think that the $72.50 level would be resistance, just as the $75 level will be. I think of those as simply stops along the way to her longer-term target. The dips will continue to be thought of as opportunities, as I think most of the market sees the idea of demand picking up through the year.